Society

For investors, glamorous bounty lies in looted treasures

By Cheng Yingqi (China Daily)

Updated: 2010-12-15 07:14

|

Large Medium Small |

Break from tradition

|

|

Antique fans look at the scroll oil painting of the Yangtze River at a retrospective exhibition of contemporary artist Wu Guanzhong at Zhejiang Art Museum in Hangzhou on Nov 20. [Li Zhong / for China Daily] |

Mainlanders are now leading the market for Chinese relics, with the majority of buyers from banking, manufacturing and real estate backgrounds, say industry experts.

Although there is no reliable figure on the number of collectors, it is believed their ranks have steadily swelled in the last two years.

"Traditional buyers of Chinese art were from Hong Kong, Taiwan and the US until 1999, with a few people from Chaozhou (an ancient city in Guangdong province) and Shanghai," said Nicolas K.S. Chow, vice-chairman of Sotheby's Asia and international director of Chinese ceramics and artwork.

"This spring, more than 50 percent of buyers at our Hong Kong auctions were from the mainland," he said. "Add the Hong Kong dealers acting on behalf of (mainland) buyers and it's fair to say mainlanders took up 70- to 80-percent (at auctions) in the past year."

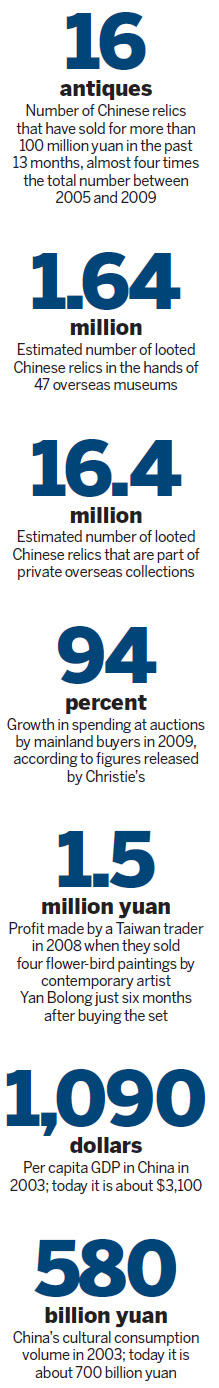

Statistics released by Christie's, another global auction house, show the spending of mainland buyers grew 94 percent in 2009.

However, as many investors entering the market are laymen when it comes to antiques, professional agents are cashing in on the demand for their expertise and services.

Yang Yufeng, a specialist who founded Beijing's Zhilan Yaji art salon, said an agent can charge "millions of yuan" for successfully bidding on a rare treasure.

It was an agent negotiating for a mystery client on the phone who snapped up the 18th-century vase in November. Bainbridge's refused to reveal the name of the winner, although they confirmed he was from the Chinese mainland, probably Beijing.

The ornament, which was made during the Qing Dynasty (1644-1911) under the rule of Emperor Qianlong, is hollow and contains a smaller vase inside that turns independently.

But is it worth $82 million?

"The vase requires exquisite workmanship. I've not seen such a good vase from the same period in China," said Liu Shangyong, general manager of Rongbao Auction Co in Beijing. "This trumps all other Qianlong vases."

Ma Weidu, owner of Guanfu Museum in Beijing, is not so sure.

"I think the bidders went to London harboring the thought the auction would not be so fierce because the auction house is not famous and the promotion was not high profile," he said. "When they arrived, they were too afraid to lose face in front of (their rivals) and bid higher and higher until it hit $82 million."

Yet, the price could also be a reflection of the shift in bidders from traditional collectors to speculators. To tell them apart, Liu suggests observers time how long it takes to go back under the hammer.

"Collectors don't sell quickly but if you see a piece at auction only two or three years after it was last bought, it's probably a case of hot money driving up the price," he said.

A scroll oil painting of the Yangtze River by contemporary artist Wu Guanzhong sold for about 38 million yuan at a 2006 auction in Beijing, yet this summer went back on the block and attracted a winning bid of 57 million yuan.

The turnaround can be even quicker. In the spring of 2008, a Taiwan trader bought four flower-bird paintings by contemporary artists Yan Bolong in Tianjin for 500,000 yuan and resold them in Beijing just six months later for 2 million yuan.

"The market has seen fast development in recent years and we're expecting consistent growth in the future," said Sun at China Guardian Auctions. "The return from investments in artwork is promising."