Society

China eyes the dream factories

By Liu Wei (China Daily)

Updated: 2010-08-08 08:27

|

Large Medium Small |

The film Shanghai starring Gong Li and John Cusack was a successful collaboration between China and Hollywood. But now, China wants to do more than just provide the pretty faces. Provided to China Daily

The film industry in China has grown in epic proportions in recent years. As studio owners get hungry for a bigger slice of the pie, they are casting their nets further afield. Next stop? Hollywood. Liu Wei reports

Early this year, it was rumored that a company from China was among the bidders for Miramax, a Disney subsidiary. By all accounts, it failed "in the competition" then, but that was just the first round. Disney has since confirmed Miramax has indeed been sold, but we still do not know if a Chinese party had been among the contenders. Ben Ji, president of Angel Wings Entertainment, a Beijing-based film financing and production group, told China Daily it had been a company backed by a provincial government. He should have the inside information. Ji has clocked 20 years working in film, television and the Internet and was with Warner Brothers' international distribution division overseeing the Chinese market for movies such as The Matrix and Troy. He was also the first local executive and country manager for Walt Disney Studios in China. He stopped at actually naming the Chinese company, but says he is optimistic about the prospects of firms in China owning a piece of Hollywood, sooner or later. His reason is simple: China has the money and needs a bigger market. And Hollywood has the traditions of drawing on foreign funds, and of skirting the strict laws on media ownership.

China's box office has grown by 25 percent yearly for the past five years. The revenue of the first six months in 2010 is 4.8 billion yuan ($780 million) - roughly the gross takings of a whole year in 2008.

Observers say the film industry will romp home with at least a record 10 billion yuan this year. But, compared with the $9.9 billion domestic revenue of the US film market in 2009, it is still miniscule.

The reason is clear. Few Chinese films have broken into the overseas markets other than those in Southeast Asia.

It is also apparent the time is ripe for Chinese film companies to start thinking bigger and further, and some are already paving the way for future ambitions.

A few are taking on more active roles in co-productions with Hollywood for a start, investing in projects rather than just offering talent and location.

The most recent example is The Karate Kid, a remake of the feel-good classic starring kungfu superstar Jackie Chan and Jaden Smith, Hollywood big-wig Will Smith's young son. The China Film Group invested $5 million in the film, co-producing with Sony Pictures.

Huayi Brothers, the biggest private media group in China, set up an international department four years ago and already boasts recent co-productions such as The Forbidden Kingdom and Shanghai. Again, Forbidden Kingdom's main draws were martial arts masters Jet Li and Jackie Chan while Shanghai depended largely on the charismatic charms of actress Gong Li as well as those of veteran actor Chow Yun-fat.

In Beijing, the government is playing its part in pushing the influence of Chinese culture worldwide - which may serve to provide the impetus for more such cooperation.

"You can tell the government's aspiration to promote Chinese culture by the mushrooming Confucius Institutes overseas," Ji says. "And Hollywood is arguably an effective channel to achieve that goal, thanks to its distribution network and global influence."

But the possible purchase of a Hollywood studio, especially a major one, may be beyond the means of a private enterprise, says a senior executive of a Hollywood studio who would rather remain anonymous.

"It would be a great challenge for an entertainment company to buy a major Hollywood film studio," he says. "Take Metro-Goldwyn-Mayer as an example. By the end of next year, any buyer who wants it will need to fork out $4 to 4.5 billion to pay off its debts in order to complete the equity transfer."

Hollywood tends to welcome buyers within the industry but it has seen some transactions that have bucked that trend. For example, Universal was bought up by the French environmental service company Vivendi SA, and the Coca Cola Company used to own Columbia.

"In view of these, it seems what Hollywood really cares about is not who buys its studios, but who has the deepest pocket."

Yin Hong, professor of film and television studies at Tsinghua University and a senior expert on the industry, agrees.

"Local entertainment companies are not likely to have the capital needed to buy a big Hollywood studio. They need to aim for the smaller, independent companies."

Ji has his views on which Hollywood studios that ambitious Chinese firms should target.

"The six major studios are not purely film companies, many of them are media conglomerates with huge capital revenue. Their purchase is a complicated process involving complex equity transfers and the Federal Communications Commission. At the moment, it is just not practical."

The most cost-effective way, Ji suggests, is to buy into small independent production companies such as Lionsgate and Summit, or studio subsidiaries such as Miramax.

"These may not have the powerful financiers and distribution channels of the big studios, but their production capabilities, brands and own unique systems targeting niche groups are also valuable."

And somebody is waiting, listening and ready to make a move.

Qin Hong, chairman of Beijing-based film studio and theater chain Stellar Megamedia, confirms that Stellar's Hong Kong-based holding company SMI Corporation has acquired Australian visual effects and CGI company Photon.

Photon's portfolio includes the Baz Luhrmann-Nicole Kidman epic Australia and Superman Returns.

"The acquisition gives technological support for Stellar's films," says Qin. "More importantly, Photon already has well-established links with Hollywood. Hopefully, Stellar will have more direct contact with the Hollywood studios through this network."

But Qin is also cautious about the Chinese film industry's global strategy.

"It is extremely important to identify which part of the target company is most valuable - whether it is the library, brand, distribution channels or creativity," he says. "We will not buy a Hollywood studio before we are fully prepared."

And if that means plenty of research, observation and more homework, Ben Ji agrees wholeheartedly.

"Take Marvel, for example. The most valuable part is its characters, not the merchandise.

"We need to work with professional US legal and audit firms before making any decision."

Although Qin Hong believes buying a Hollywood studio will provide a quality platform to promote Chinese culture, he says his first priority would be still to strengthen the brand name before anything else.

"If you are in too much of a hurry to label the company as a carrier of Chinese culture, that may draw hostility from the US audience, and may eventually even destroy the brand."

When Sony bought Columbia in 1989, the deal stirred a cultural backlash in the States, but Sony eased the criticism by operating Columbia as a purely American company and avoided using it to promote anything Japanese.

The knee-jerk reaction to a Chinese company buying up a piece of Hollywood may be worse.

"There are more differences in ideology, the social system and in core values. Even more so than with Japan," Ben Ji says. "Keep it as pure business, and it may just work."

A scene from The Mummy: Tomb of the Dragon Emperor. Exotic locations aside, Chinese film-makers want equal partnership with Hollywood.

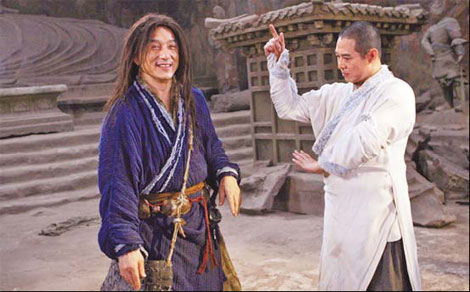

Huayi Brothers has actively courted Hollywood with co-productions such as The Forbidden Kingdom, which features Jackie Chan and Jet Li. Provided to China Daily