Government and Policy

5% tax on oil, gas in Xinjiang

By Cui Jia (China Daily)

Updated: 2010-06-03 06:50

|

Large Medium Small |

URUMQI - Producers of crude oil and natural gas will be levied a new sales tax in the Xinjiang Uygur autonomous region, the Ministry of Finance said on Wednesday.

| ||||

Xinjiang will be a pilot project in resource tax reform to be introduced nationwide.

"It's about time the central government started levying the resource tax based on price," Ashar Turson, president of Xinjiang University of Finance and Economics, told China Daily.

"The regional government has been proposing such a reform to the central government for 7 years; and Xinjiang would have benefited more as a resource supplier."

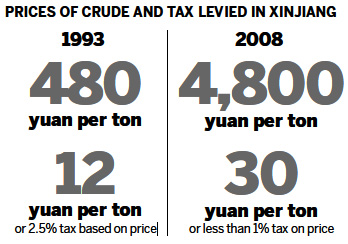

When the price of crude was 480 yuan ($70) per ton in 1993, the resource tax at that time was 12 yuan, amounting to 2.5 percent, Ashar said.

The new measures will boost Xinjiang's fiscal revenue by over 2 billion yuan by the end of this year and could generate up to an extra 10 billion yuan every year, almost a quarter of its total, he said.

"But I believe even 5 percent is quite low compared to some other countries. Crude oil and natural gas should be taxed at between 8 and 10 percent," he said.

Chen Yuenian, an official with the Xinjiang tax bureau, told China Daily that "levying the resource tax based on price instead of volume will increase the revenue of the regional government by a large margin. The extra revenue could be used to improve people's living standards and boost the economy, which could help maintain social stability and ethnic unity".

"The new measures are also a crucial step to save natural resources by raising consumption costs."

Around 60 percent of Xinjiang's population are ethnic groups such as the Uygur, Kazak and Uzbek. The region is also the source of 13 percent of the country's crude oil production and almost 30 percent of its natural gas output.

Oil and gas production accounted for 30 percent of Xinjiang's economic output last year. The region has three large oil fields - Karamay, Tarim and Tuha - all run by PetroChina, which will be affected the most by the new tax. The company is the biggest oil and gas producer in the country.

"The prices of natural gas nationwide might go up after the new resource tax in Xinjiang," said Dong Xiucheng, vice-president of the college of business administration of China University of Petroleum.

PetroChina plans to nearly double its annual gas output in Xinjiang to 30 billion cubic meters by 2015, while Sinopec wants to increase its output nearly five times to 5 billion cubic meters a year by 2015.

A resource tax on coal and nonferrous metals has not been included in the reform this time because it is logical to choose the oil and gas sectors to start with, experts said.

"Coal accounts for around 70 percent of China's total energy mix, while oil and gas make up a smaller part," said Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University.

The long-discussed re-source tax reform should be step by step, he said, adding that coal will be included in the future.

Xinhua, Wan Zhihong contributed to the story