China is likely to further cut its tax rebate for steel exports if it fails

to curb the increasing export volume, said Luo Bingsheng, executive

vice-chairman and secretary-general of China Iron & Steel Association

(CISA).

China is likely to further cut its tax rebate for steel exports if it fails

to curb the increasing export volume, said Luo Bingsheng, executive

vice-chairman and secretary-general of China Iron & Steel Association

(CISA).

"If the government's macro-control efforts fail to curb the surging exports,

a lower tax rebate is likely very soon," Luo told China Daily yesterday on the

sidelines of the annual session of the National Committee of the CPPCC.

"In the meantime, the government will raise export tariffs on primary steel

products such as pig iron, steel slab and steel billet."

"In the meantime, the government will raise export tariffs on primary steel

products such as pig iron, steel slab and steel billet."

The move to cut the tax rebate was launched in December. Another round of tax

cuts are widely expected in April. But Luo declined to comment on the date.

But he stressed that the high momentum in steel exports in January will speed

up the pace of introduction of the new rebate.

If implemented, it will be the fourth time the Chinese government will

introduce such a countermeasure to curb exports.

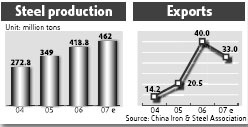

CISA figures indicate that steel exports amounted to 43 million tons last

year, up 109 percent year-on-year.

"The nation's rocketing steel exports last year are a

result of increased competition between domestic steelmakers as well as the

bullish international steel market," Luo  said.

said.

"On the other hand, China's exports helped address the international shortage

caused by increasing demand."

His remarks were in response to growing dumping charges made by foreign

countries against Chinese steel products. Eleven nations have launched 27

anti-dumping investigations into steel products from China, worth $900 million

since its entry into the World Trade Organization in 2001.

Luo said he expected the nation's 2007 steel exports are not likely to

continue to surge after the countermeasures.

"It will tend to maintain the same level as 2006. And, exports this year

should focus more on steel products with higher technology and added-value," he

said.

Crude steel production in China surged by 18.5 percent to 418.8 million tons

last year from 2005, according to CISA data. The organization has predicted

production this year will grow by 10 percent.

Luo yesterday also protested against the surging iron ore prices. Ore prices

have been rising rapidly in recent years, boosted mainly by strong demand from

China, the world's biggest iron ore consumer and importer.

The world's three largest iron ore producers Companhia Vale do Rio Doce from

Brazil and Australia's BHP Billiton and Rio Tinto want to raise 2007 prices by 5

to 10 percent next year after two consecutive hikes in the past two years.

(China Daily 03/07/2007 page14)