Australia, the world's second- biggest uranium

exporter, will sign an agreement with China allowing Asia's biggest energy

consumer to tap nuclear fuel worth A$100 billion ($71.4 billion) for power

generation.

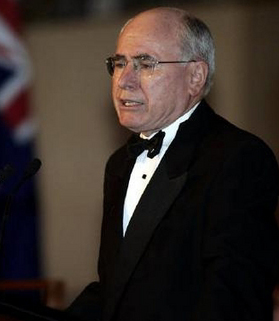

Australian Prime Minister John

Howard is seen delivering a speech during a dinner in Canberra in this

March 14, 2006 file photo. Negotiations between Australia and China on

uranium trade are progressing well and a deal could be signed when Chinese

Premier Wen Jiabao visits Canberra next week, Howard said on Tuesday.

[Reuters] |

Exports to China may start within four

years, Australian Resource Minister Ian Macfarlane said today. An agreement to

ensure uranium supplied to China is used only for civilian purposes is scheduled

to be signed in Canberra today by China's Premier Wen Jiabao and Australian

Prime Minister John Howard.

China and India are both racing to secure nuclear fuel supplies as they seek

to cut reliance on oil and coal to power economic expansion. The accord may

boost shares of Rio Tinto Group's Energy Resources of Australia Ltd., the

nation's largest exporter of uranium, and BHP Billiton, whose Olympic Dam

contains the world's biggest-known uranium reserves.

"The obvious companies benefiting from this will be the producers, BHP and

Rio," said Neil Boyd-Clark, who helps manage the equivalent of $2.5 billion

including BHP Billiton and Rio Tinto shares, at ABN Amro Asset management Ltd.

in Sydney. "For the Chinese, this will be important in security of supply. Right

now the whole world seems to be looking for uranium."

Shares in BHP Billiton rose 15 cents, or 0.5 percent, to A$28.15 on the

Australian Stock Exchanges at 10:10 a.m. Sydney time. Energy Resources rose 2.3

percent to A$14.85.

Australia is the world's largest holder of low-cost uranium resources. It has

41 percent of global uranium reserves, though it meets only 21 percent of demand

due to mining bans at state government level. China plans to boost its nuclear

energy fourfold by 2020.

Commercial Talks

"The signing of this agreement is really only the start of the process," said

Macfarlane in a radio interview with the Australian Broadcasting Corp. "We need

to move forward, there needs to be commercial negotiations between companies in

Australia that are producing uranium and companies in China that wish to

purchase it."

Australia only allows uranium mining at three mines owned by BHP, Energy

Resources and a unit of San Diego-based General Atomics. Australia has a fourth

uranium mine that's been approved for development. The owner of the Honeymoon

project in South Australia, Toronto-based SXR Uranium One Inc., is due to decide

by mid-year whether to develop it.

Uranium prices have surged almost fourfold in the past three years, as more

countries turn to nuclear power generation after prices for coal, gas and oil

rise and pressures increase to cut emissions of greenhouse gases, blamed for

global warming.

Operating Reactors

At the start of the year, there were 441 operating reactors, and another 24

under construction, according to the London-based World Nuclear Association. An

extra 41 plants have funding and approvals in place. China plans to build 28

power plants to meet rising demand for energy, according to the association.

Uranium prices may jump another 34 percent this year to $54 a pound,

according to Resource Capital Research. The spot price was at $40.25 a pound on

March 24, according to industry publication Metal Bulletin.

China's Premier Wen wants to establish a price setting mechanism as part of

the agreement between Australian and China, the Australian Financial Review

reported, citing Wen's comments to businesses executives in Perth yesterday.

The comments raised fears of a repeat of the damaging spat between China and

its trading partners over iron ore prices, the newspaper reported. Macfarlane

played down the comments, saying prices would be set as part of normal

commercial arrangements, the paper said.

Two Assets

BHP's Olympic Dam holds more than a third of the world's known uranium and

the company is studying spending more than A$4 billion on an expansion that

would triple uranium production, as well as increase gold and copper output.

Energy Resources in October raised its estimate of uranium reserves at Ranger

and said the additional reserves would add three years to the operating life of

the mine.

"When you look at those two assets, they have the ability to expand pretty

quickly, especially Olympic Dam for BHP Billiton," said Mark Pervan, head of

research at Daiwa Securities SMBC in Melbourne.

For China to get access to more uranium, the Australian Labor Party, which

governs in Australia's six states, will need to remove bans on mining the ore, a

move that the party's energy spokesman, Martin Ferguson, said March 31 should be

considered.