Editor's note: As some observers become concerned that foreign businesses will move factories or investments out of China and transfer them elsewhere during the country's economic slowdown, a series of our reports look at the increasing tendency of foreign investment to go into western China.

|

Foreign firms finding new fields |

|

|

|

Foreigners at the investment and trade fair for cooperation between eastern and western China in Xi'an, Shaanxi province on April 5. Business representatives from 67 countries and regions attended the fair to seek trade and investment opportunities. [Photo / China Daily] |

While labor costs are increasing rapidly along the coasts of East China, more foreign companies such as Samsung are looking to the country's west. Their plans promise to both bring renown to the region and to turn it into a magnet for foreign investment in the coming years.

In October, Samsung's headquarters decided to open a factory there. But the region didn't immediately grab the company's attention.

"Xi'an wasn't on the list even at the beginning," said Kwon, declining to elaborate on that statement.

After learning Samsung wanted to make a large investment somewhere in China, the Shaanxi government formed a special team charged with talking to the company. Two months later, Xi'an appeared on a final list of places that the company was most seriously considering investing in, finding a place alongside Beijing and Chongqing. Samsung chose Xi'an in March.

The city's greatest asset is its government support, said Kwon Oh-hyun, vice-chairman of Samsung.

"Their great enthusiasm (in attracting the project) was so impressive that it triggered our decisions," he said.

To provide Samsung with a site for the project, the Xi'an municipal government prepared an area of 9 square kilometers in the western part of the city. Xi'an is also planning to establish an area that Samsung can use to import supplies tariff-free.

"We spent days on completing Samsung questionnaires that included more than 1,000 questions, and they covered a wide range of matters and issues, even including the quality of electricity in Xi'an," said Zhao Hongzhuan, a member of the Standing Committee of the Xi'an Municipal Committee of the Communist Party of China.

"We responded quickly to all their requirements, and of course, we were lucky to win the project.[Full Story]

|

Star cities in race for foreign capital |

|

|

|

A folk art performance attracts visitors to the four-day 15th China Chongqing International Investment and Global Sourcing Fair, which ended on Sunday. More than 7,000 foreign enterprises from 43 countries and regions attended the fair. [Photo / Xinhua] |

Xi'an, Chengdu or Chongqing, where to invest? This will be a hard choice for foreign investors.

"The story of western China is appealing," said Andy Serwer, managing director of Fortune magazine.

But exactly where to go is a question for foreign companies, and it takes time to make a final decision.

The cities of Chengdu, Chongqing and Xi'an have led the economic growth of China's west, and they are also in the vanguard of growth in foreign direct investment in the region.

In 2011, the GDP of the three cities - Chongqing, Xi'an and Chengdu - rose by 16.5 percent, 13.8 percent and 15.2 percent to 1 trillion yuan ($158.2 billion), 386.4 billion yuan and 685.5 billion yuan, respectively.

The figures were higher than the growth rate of 9.2 percent for the nation as a whole and 13 percent for the western region last year.

Among the three cities, Chengdu has been an early bird in absorbing FDI.

Xi'an and Chongqing have also emerged as rising stars.

During the past one or two years, Chongqing has quickly gained momentum and attractiveness as an FDI destination. In 2011, the city's FDI hit a record high of $10.53 billion, almost one-fifteenth of the national total.

Compared with Chongqing and Chengdu, Xi'an is late in opening up. [Full Story]

|

Momey on the move |

|

|

FDI drop due to global factors

Experts say country should focus on improving business environment

Foreign direct investment in China fell for the sixth straight month in April. There were many reasons for the decline, which analysts said was mainly due to the European debt crisis and the sluggish global economic recovery.

As the United States and European countries are trying to attract more foreign capital, people have started to wonder: will the competition from those countries also affect China's inward investment?

Some experts from the US and Europe do not think that the rise in US and EU FDI inflows has directly led to the decrease in China.

China should not worry too much about the slowing FDI growth rate, but should focus on restructuring its economy and improving the investment environment, they said.

"The attraction for FDI in China differs from that in the US and EU. A large amount of FDI inflow to China is linked to the country's export sector, while much FDI inflow to the US and EU is aimed at serving the domestic market. They are not easily interchangeable," said Ting Xu, senior project manager at Bertelsmann Foundation. [Full Story]

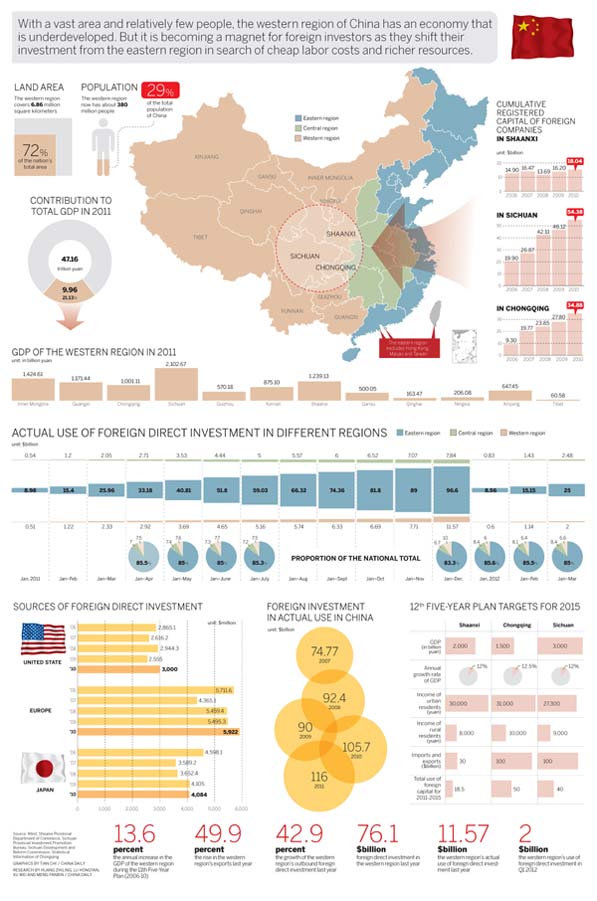

Foreign investors warm to western region

China's western region, with its lower land and labor costs, is becoming a new hot spot for foreign investment.

That is good news for the entire country, a large part of which remains relatively underdeveloped. But should the eastern coastal region be worried that sharing foreign investment with the west will stall its growth?

Not necessarily, according to analysts.

First, more investment in the west doesn't necessarily mean less in the east. Foreign companies could just be investing more.

Second, even though some investment will be diverted to the west, this is chasing lower labor and land costs, which the east is no longer able to offer at its current stage of development.

For now, a larger part of foreign direct investment still goes to the east, but FDI to the west is growing at an astonishing rate. [Full story]

Rebound to come despite continued string of declines

It is probably true that some foreign companies have moved their production facilities outside China to other Asian nations, but the majority of them are in labor-intensive industries. I am confident that companies, especially from market-oriented and capital-intensive industries, will continue to look at the Chinese market, focusing on the long term. [Full story]