Companies

Firms cite fund shortage as key growth hurdle

By Cai Xiao (China Daily)

Updated: 2011-04-08 10:50

|

Large Medium Small |

|

|

|

Laborers at a factory in Huaying, Sichuan province. According to a survey, more than 40 percent of entrepreneurs said a capital shortage prevents them from expanding their businesses and they are seeking external financing support. [Photo / China Daily] |

BEIJING - Chinese entrepreneurs regard a shortage of funds as one of the most serious problems preventing their development, and they intend to more actively tap into the capital markets to raise money, according to a survey of more than 4,000 enterprises around China.

The survey was conducted by China Entrepreneurs Survey System (CESS), a research agency set up by the State Council, offering suggestions for government and enterprises.

According to the survey, more than 40 percent of entrepreneurs said a shortage of capital prevents them from expanding their businesses, and they are seeking external financing.

Of the enterprises surveyed, 366 are large, 1,766 middle-sized and 2,124 small.

The survey showed that from 2008 to 2010, bank loans and private lending were two major ways for companies to get funds.

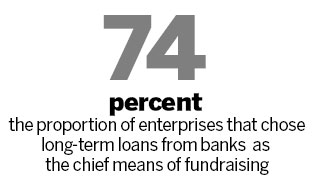

More than 74 percent of the enterprises surveyed chose long-term loans from banks as the chief means of fundraising, and 55 percent chose private lending.

The larger enterprises had diversified financing channels, including bank loans, private lending, syndicated loans and initial public offerings. Small- and medium-sized enterprises and private companies had difficulty in getting bank loans because they had relatively less collateral and posed higher risks. They relied mainly on private lending.

Meanwhile, 23 percent of the respondents chose to seek private equity or venture capital, nearly double the percentage of the last three years, the survey showed.

Of the large enterprises, 44 percent said they are likely to seek a market listing in the coming three years, and 30 percent of middle-sized enterprises said they would like to go public between 2011 and 2013.

Small companies also are intent on going public, as 13.5 percent of those surveyed said they will seek a listing within the coming three years, a 20-fold increase from the 0.7 percent of the past three years.

According to the survey, Chinese entrepreneurs said they have confidence in their ability to raise money in the capital market. Board directors and general managers attach great importance to capital markets and said they have financial knowledge and want to bring in related talents.

In the survey, entrepreneurs said cracking down on insider trading, standardizing the corporate mechanism and improving the legal system are the most essential needs for the development of the capital market.

| 分享按钮 |