Statistics

China's CPI up 4.6% in December 2010

(Xinhua)

Updated: 2011-01-20 10:52

|

Large Medium Small |

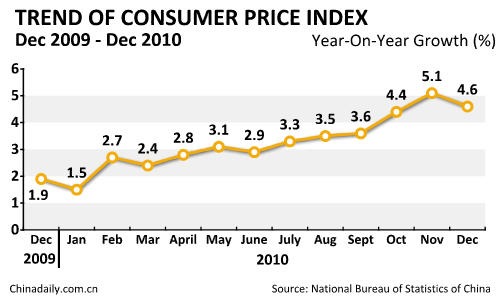

BEIJING -- China's consumer price index (CPI), a main gauge of inflation, rose 4.6 percent in December year on year, the National Bureau of Statistics (NBS) announced Thursday.

The CPI was up 3.3 percent in 2010 from the previous year, the NBS said.

The monthly figure was slightly lower than November's 5.1 percent, a 28-month high, but slightly higher than October's 4.4-percent growth.

The rise of food prices in December was down from 11.7 percent in November, 10.1 percent in October, 8 percent in September and 7.5 percent in August.

China's producer price index (PPI), a major measure of inflation at the wholesale level, rose 5.5 percent last year.

The December PPI rose 5.9 percent year on year and 0.7 percent from November, the NBS said.

The PPI rose 6.1 percent year on year in November, compared with a 5-percent gain in October.

"The CPI growth of 3.3 percent last year was not high as the index had hit 4.8 percent in 2007 and 5.9 percent in 2008," said Zhang Liqun, a researcher at the State Council's Development Research Center.

Zhang said the government measures to cool rising prices had begun to take effect with vegetable prices falling and grain and cooking oil prices stabilizing.

"The figures indicate China's overall supply and demand generally struck a balance. It is essential for the healthy growth of a country's real economy," Zhang said.

The month-on-month fall in December CPI from November was mostly a trick of base effect, and to a lesser extent a result of good weather and government efforts in adding supply, said Lu Ting, China economist with the Bank of America-Merrill Lynch.

Looking forward, Lu expects the CPI to spike again in January, due mainly to the timing of the Chinese Lunar New Year holiday and worsening weather.

The CPI might decline moderately after February if the weather normalizes, Lu added.

Despite obvious progress in taming prices in December, China faces challenges in curbing rising prices this year, NBS director Ma Jiantang said.

One challenge is the fact some developed economies have introduced quantitative easing monetary policies, resulting in soaring international commodities prices, Ma said.

China's monetary state of recent years, designed to fight the global economic crisis, has brought inflationary pressures, Ma said, adding that soaring labor and land costs also push up prices.

But he also pointed to Chinese strength in taming soaring prices this year.

China gathered a bumper harvest last year and the industrial supply exceeded demand, putting downward pressure on prices, Ma added.

The Chinese government has decided to implement a prudent monetary policy this year and has taken measures to control currency flows, which are measures that rein in prices, Ma said.

| 分享按钮 |