Economy

CPI increase sparks worries

By Xin Zhiming and Wang Xiaotian (China Daily)

Updated: 2010-10-22 09:26

|

Large Medium Small |

|

|

The central bank raised the interest rate for the first time in almost three years on Wednesday to combat inflation and soak up excessive market liquidity.

In remarks that may provide some insight into the reasons that led the central bank to the hike interest rate, central bank governor Zhou Xiaochuan drew attention to a series of potential pitfalls.

"Macro-economic risks linked to excessive liquidity, inflation, asset bubbles and a cyclical rise in bad bank loans are rising significantly," he said in comments published on Thursday.

He made the remarks at a meeting between the International Monetary Fund and central bankers in Shanghai early this week.

"There is still relatively strong momentum for domestic credit to keep expanding," Zhou said.

Zhou added that the "asset quality and risk-resisting capabilities of the financial industry will face serious tests".

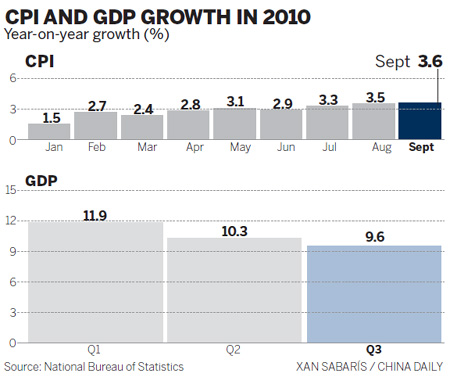

But the third-quarter GDP data should alleviate such concerns, economists said.

"The data sent a very optimistic signal to the rest of the world that China would secure a GDP growth rate of nearly 10 percent this year," Zhuang Jian, senior economist at Asian Development Bank in China, said.

"We do look for further (interest rate) hikes at some point, if domestic asset prices continue to rise," said Li Wei, an economist with the Standard Chartered Bank. "We still forecast two hikes in the first half of 2011."

Government's measures to cool the housing market as well as the closing of outdated industrial capacity slowed growth, said Zhu Baoliang, a researcher with the State Information Center.

But "the economic performance is generally sound," NBS spokesman Sheng said.

Reuters and AFP contributed to this story.