Economy

Inflationary pressure 'could ease'

By Wang Bo (China Daily)

Updated: 2010-08-12 08:48

|

Large Medium Small |

BEIJING - China's inflationary pressure might ease for the rest of the year, as grain price hikes on the international market are unlikely to spill into the country because of ample grain reserves, economists have said.

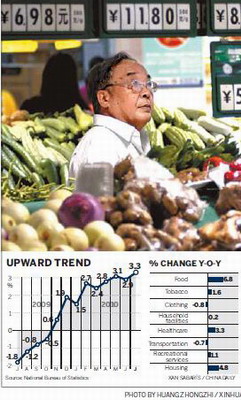

The country's consumer price index (CPI), a major gauge of inflation, climbed 3.3 percent in July - a 21-month high - from 2.9 percent in June, as recent floods pushed up food costs, the National Bureau of Statistics (NBS) said on Wednesday.

Policymakers have vowed to keep high food prices under control.

In a State Council executive meeting presided by Premier Wen Jiabao on Wednesday, top policymakers pledged to fight unfavorable weather conditions to reap a bumper harvest this autumn.

Growth of crops in autumn grain areas has "so far been sound", which will lay the foundation for a good harvest despite natural disasters, according to the meeting.

The high CPI figure in July, in addition to surging prices on the international commodity market, has raised concerns that the country's CPI could further strengthen in the coming months and prompt the authorities to tighten monetary policies and even raise interest rates.

But NBS spokesman Sheng Laiyun insisted that China is able to keep prices "basically stable" for the year and meet the government's annual inflation target of 3 percent.

"The CPI hike in July was largely due to the low base of last year and recent dramatic weather conditions across the country ... generally speaking, there are more factors that will curb price rises than those that will fuel price rises," he said.

A number of economists shared Sheng's view. The country's inflation has reached its peak in July and inflationary pressure will ease in the coming months, they said.

China's ample grain reserves will also help stabilize food prices, said Zhang Liqun, senior research fellow at the National Development Research Center of the State Council.

"Grain price is not a major concern this year, as the country has ample staple reserves after reaping bumper harvests for six consecutive years," he told China Daily.

The natural disasters this year will not impact China's harvest seriously, he said.

"The drought at the beginning of the year has only limited impact on the country's overall staple food output, as grain output this summer is China's third largest on record, despite the fact that it dropped a little year-on-year," he said.

Earlier reports said China has imported 600,000 tons of rice from Vietnam since the beginning of this year, causing worries that the world's most populous nation has started to stockpile grain against any shortage.

But Zhang said the move might be aimed only at adjusting the reserve portfolio, as 600,000 tons of rice imports are quite limited compared with China's annual grain output of about 500 million tons.

Zhang Xiaojing, an economist at the Chinese Academy of Social Sciences, said the ongoing economic slowdown will also reduce demand for money supply, which could help ease inflationary pressure.

China's industrial output grew 13.4 percent year-on-year in July, down from 13.7 percent in June. Fixed assets investment rose 24.9 percent in the first seven months of this year, down from 25.5 percent in the first half of the year.

The changes provided fresh signs that the economy is slowing due to the government's tightening measures on the property sector and curbs on lending.

"The ongoing economic deceleration is conducive to economic structural adjustments," Ma Jun, chief China economist at Deutsche Bank, said in a research note.