Opinion

Time to unwind stimulus in East Asia

By Srinivasa Madhur (China Daily)

Updated: 2010-07-22 13:58

|

Large Medium Small |

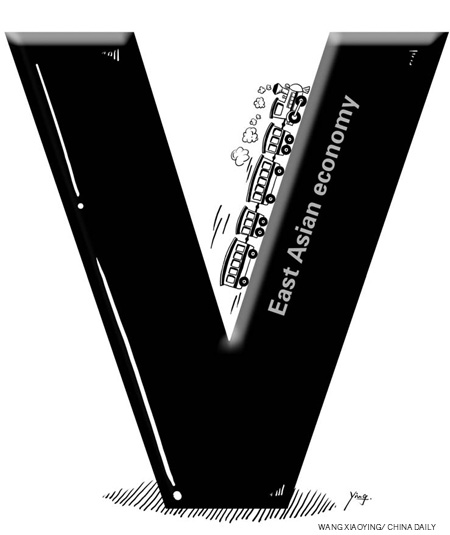

Emerging East Asia is virtually assured of a V-shaped recovery from last year's economic slump. It is still too early to proclaim that the "V" stands for "victory", though. But with the recovery on track, it is now time to unwind the policy stimulus that has helped power the recovery. Whether or not the recovery is sustainable depends heavily on the timing, policy mix and pace at which the economic stimulus is withdrawn.

As governments begin to unwind their policy stimulus, a "money first" strategy - in which policymakers normalize monetary policy first and consolidate fiscal policy later - is appropriate for most of the emerging East Asian economies. Considering the need to rebalance the region's sources of growth, there is merit in normalizing monetary conditions through a judicious mix of currency revaluation and interest rate adjustments rather than through policy rate hikes alone.

The pace at which economies unwind their stimulus should depend on the speed of recovery as well as evolving risks. So, the authorities must ensure that the private sector is strong enough to take over the slack created by the withdrawal of policy stimulus.

The Chinese authorities are carefully pulling back the stimulus by putting a cap on banks' lending, increasing bank reserve requirements and giving the yuan a bit more flexibility. The aim is to contain inflationary pressures, avoid overheating and keep potential asset bubbles (in the real estate sector) in check while maintaining robust growth.

In the Republic of Korea (ROK), Malaysia, Singapore and Thailand, normalization has already begun, and should continue at what appears to be an appropriate pace. And countries such as Indonesia, the Philippines and Vietnam, which are yet to start unwinding their policy stimulus, may need to start soon. In every case, unwinding policy stimulus should be in step with the speed of the region's recovery, yet always mindful of the risks facing the global economy.

With households, enterprises and even governments in advanced economies of North America and Europe deleveraging and restructuring their balance sheets, demand for the products "Factory Asia" makes can no longer be counted on as a primary source of growth. Without shunning globalization or turning inward to "Fortress Asia," developing economies in the region will need to increase cooperation and deepen economic integration, using their huge savings to finance cross-border infrastructure, ease intra-regional trade and investment, and develop more sophisticated financial markets.

The reason emerging East Asia has done so well in the face of global adversity is simple: it was not part of the problem. It had learned its lessons well from the Asian financial crisis of the late 1990s, its governments reacted quickly with monetary and fiscal stimulus, and businesses and consumers both retained confidence in the region's ability to continue to prosper.

The Asian Development Bank (ADB) estimates that the combined GDP of the region will increase by 8.1 percent this year, much higher than last year's 5.2 percent, and well above the 6.7 percent growth the region posted in 2008. That is quite a high rate of growth considering the world is only gradually climbing out of its biggest economic crisis since the Great Depression.

China, of course, has been at the epicenter of emerging East Asia's economic upsurge. Its policy stimulus package was by far the region's largest. Its growth in first quarter of this year was a torrid 11.9 percent. The second quarter was slightly tamer at 10.3 percent, with investments made last year accounting for nearly 90 percent of the growth. The ADB forecasts the trend will continue, with economic growth this year and next year being 9.6 percent and 9.1 percent.

After being badly hit by the global economic crisis in the early part of 2009, the newly industrialized economies of Hong Kong and Taiwan, and the ROK, and Singapore are forecast to achieve a solid 6.2 percent growth this year, moderating slightly next year.

The economic prospects of the four mid-income ASEAN economies, Indonesia, Malaysia, the Philippines and Thailand, look good for this year after last year saw their poorest performance since the Asian financial crisis. Leading indicators continue to improve in these economies, with strong industrial production growth and rising consumer confidence. This is also true for most other ASEAN economies. Together, ADB expects ASEAN to expand by 6.7 percent this year.

Emerging East Asia's "V for victory" may still be far away. But at the moment, it is certainly forging the right path.

The author is senior director of the Office of Regional Economic Integration at the Asian Development Bank.