Economy

Housing prices 'to fall in Q4'

By Hu Yuanyuan and Cheng Yingqi (China Daily)

Updated: 2010-07-06 09:10

|

Large Medium Small |

Minister's remarks 'reflect govt's resolve to cool property market'

BEIJING - Property prices are likely to start falling in the last quarter of the year as tightening measures for the sector continue, officials and analysts have said.

Dropping sales volume and stagnant prices could lead to a deeper price slump in the market, Minister of Land and Resources Xu Shaoshi said on Sunday.

"In about three months, the property market will probably reach a comprehensive correction and prices will fall in some areas. But it's hard to predict the extent of the price drop, which may vary from city to city," Xu was quoted by China News Service as saying at a conference in Dalian, Liaoning province.

The ministry will strengthen property management and clear up idle land to ensure land supply for affordable housing, he said.

Xu's latest remarks reflect the central government's resolve to curb excessive property prices, said Grant Ji, director of real estate service provider Savills (Beijing).

In late June, the Ministry of Housing and Urban-Rural Development held a forum in Qingdao and pushed for an individual housing information system to supervise mortgages and stem speculative activities in the housing market.

Similarly, Hu Cunzhi, chief planner of the Ministry of Land and Resources, said at a recent forum that the government will raise the threshold for developers to bid for land, asking them to set aside money that is 30 percent of the land's bottom price - as compared to 20 percent previously - during the bidding process.

| ||||

Since April, the government has launched a slew of measures to cool down the sizzling property market, including tightening bank lending as well as hiking down-payment and mortgage rates for second-home buyers.

Property sales volume has since plummeted, but prices remain stable.

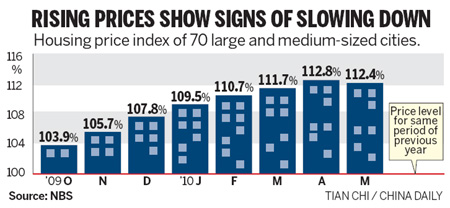

Realty prices in 70 major cities nationwide rose 12.4 percent year-on-year in May, compared to the record 12.8 percent hike in April, figures from the National Bureau of Statistics showed. The month-on-month increase was 0.2 percent in May, compared with 1.4 percent in April.

Many people had expected housing prices to drop. According to a recent survey by China Index Academy, of the 964 Beijing homebuyers polled, 39.2 percent expected a slight drop in realty prices, while 19.8 percent anticipated a steep fall. Only 2.5 percent of those polled believed prices would continue rising.

Half of the respondents also believed that government policies were well enforced, compared to less than 20 percent of respondents in the first quarter. Only 8.3 percent of those polled said they would immediately buy a home, compared to nearly 18 percent in the first quarter.

"The housing agency next to my company has had much fewer visitors in recent weeks," 24-year-old Beijinger Wang He said.

"I believe housing prices will come down if the government really wants it to."

A substantial price adjustment may come in the fourth quarter, when property developers' cash flow tightens after slow sales and increasing difficulty in obtaining financing, said Lin Lei, marketing chief of US-listed real estate brokerage Century 21st.

"Property developers' best solution is to cut prices before more stringent policies are rolled out," Lin said.