Economy

Int'l monetary system needs yuan as 'third leg'

(Xinhua)

Updated: 2010-07-05 09:39

|

Large Medium Small |

|

|

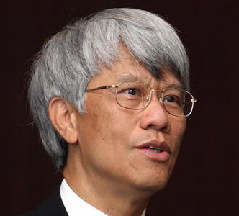

| Joseph Yam |

In a recent interview with Xinhua, Yam said the Chinese yuan or renminbi, as a sovereign currency, has the greatest potential to become a third leg though it still has a far long way to go.

Yam also said Hong Kong, as a financial hub blessed with the advantage of "one country, two systems" principle, was an ideal place for the internationalization of the renminbi and to help the renminbi achieve the status as a third leg.

THIRD LEG

Yam, easily recognized with an abundance of silvery white hair, is a famous financial veteran in Hong Kong. Since retirement in September last year, he serves as the executive vice-president of the China Society for Finance and Banking, a think tank under the People's Bank of China, the country's central bank.

According to Yam, the international monetary system was worrisome and seemed structurally unstable, with its two supporting legs -- the US dollar and the euro -- not commanding the level of international confidence needed to sustain their status.

The overall economic pictures of the US and the euro-zone, the quantitative easing monetary policies and the level of indebtedness all had an adverse impact against investors' long- term confidence over the two currencies, he said.

|

||||

Yam said chances of a sovereign currency becoming a third leg were higher, since few economies were willing to use the long- existing SDRs and many people would have reservations about new Asian Currency Unit given the experience of the euro.

"If the third leg falls in the form of a sovereign currency, it must be the renminbi," he said, citing China's growing economic size and effective macroeconomic management over the last two decades.

To become a third leg, however, the renminbi needs much more good preparations and achieves the internationalization, Yam said, adding recent moves by China's central bank indicated the country was pushing forward with the internationalization of the renminbi step by step.

On June 19, the central bank decided to proceed further with the reform of the renminbi exchange rate to add flexibility to the renminbi exchange rate. Days later, it decided to expand a trial program for settling trade deals in the renminbi to most of the country.