Infographic

Firms cautious about IPOs

By Zhang Ran (China Daily)

Updated: 2010-03-08 10:02

|

Large Medium Small |

|

|

|

Empty desks during a break at the Shanghai Stock Exchange. After the global economic downturn, mainland businesses were naturally cautious when asked about their listing plans. [Qilai Sheng/Bloomberg] |

BEIJING: Chinese companies are becoming more cautious about listing publicly in the light of the economic downturn, according to a recent report released by leading accounting firm Grant Thornton International.

Only 11 percent of businesses surveyed on the Chinese mainland in 2010 expect to undertake a public listing in the next three years, down from 20 percent of businesses in 2009 and 60 percent in 2008, it revealed.

The so-called Grant Thornton International Business report is an international survey of the opinions of medium to large businesses, in which more than 7,400 chief executive officers, managing directors, chairmen and other senior executives from 36 economies across all industry sectors were questioned. 300 businesses were surveyed on the Chinese mainland including 100 State-owned and public sector and 200 privately-owned companies.

"While flotation offers extra capital and greater visibility in the market place, listing may also create volatility along with the increased cost of going public and maintaining a listing. Therefore, despite an improving economic outlook, businesses are naturally cautious when asked about their listing plans," said Xu Hua, chairman of Grant Thornton.

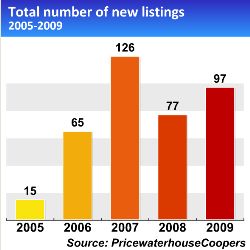

According to the report, the proportion of respondents considering IPOs globally fell from 22 percent in 2008 and 10 percent in 2009 to this year's 7 percent.

Some IPO markets have been identified as those which are set to drive global capital market activity, notably the Brazilian, Russian, Indian and Chinese (BRIC) economies which represent emerging markets least affected by the financial turmoil.

Respondents surveyed among BRIC nations are consistently twice as optimistic when asked about their listing plans compared with the global average. On a country level, India tops the ranking with 33 percent expecting to undergo a public listing in the next three years.

"At the start of 2010, businesses are also showing signs of optimism, both in their belief that the upturn is about to start and in their confidence that the IPO window is once again re-opened," said Xu. "Those who have survived the global economic downturn are now in a stronger position to attract investors than they have ever been."

The survey also asked respondents about their intentions for acquisition. 26 percent of mainland Chinese businesses plan to grow by this method in the next three years, compared with 41 percent 12 months ago. Among these, 81 percent of businesses said this would be through domestic acquisition and 17 percent through cross-border acquisition, compared with 69 percent and 23 percent respectively 12 months ago.

"Over the last 18 months many businesses have taken actions to reduce costs. 2010 is likely to see some stronger businesses undertaking strategic acquisitions or mergers to drive further efficiency, resume growth and enhance margins," the report said.

For those businesses that do have cash resources, the combination of a more stable global economy and comparatively low valuations is throwing up interesting acquisition opportunities, it added.