|

BIZCHINA> Top Biz News

|

|

Mainland stocks headed for 'sizable correction'

(China Daily/Agencies)

Updated: 2009-07-09 08:00

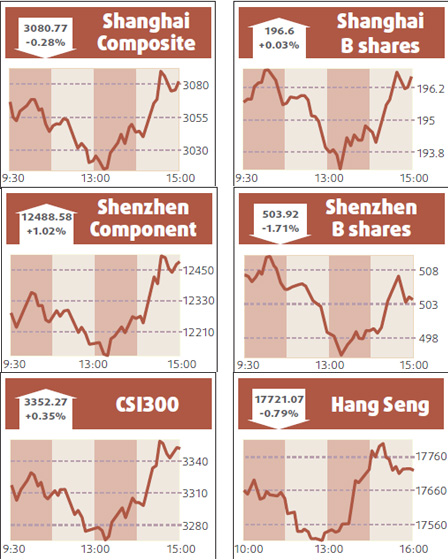

Mainland stocks may be headed for a "sizable correction" after a so-called momentum indicator for the Shanghai Composite Index advanced to the highest in at least five months. The 14-day relative strength index, or RSI, for the Shanghai Composite climbed to 83 this week, above the 70 threshold that signals to technical analysts an asset or market is poised to fall. The indicator compares the magnitude of recent gains to losses. The last time the Shanghai gauge's RSI breached the 80 level, in February, the stock measure sank as much as 13 percent in following two weeks. "The RSI shows that the market is in a pretty overbought situation," said Barole Shiu, a Hong Kong-based technical analyst at UOB-Kay Hian Ltd. "If history repeats itself, there is a very strong chance we'll see a sizable correction."

At the stock measure's peak in October 2007, its RSI reached 79.6, a level not seen again until this year. The Shanghai Composite plunged 72 percent in the following 12 months before rebounding, according to data tracked by Bloomberg. Shiu said the Shanghai A Share Index, the stock gauge he tracks, may fall at least 200 points, or 6 percent, before finding a support at around 3000. The measure, which tracks only yuan-denominated shares traded in Shanghai, yesterday closed at 3243.29. Its RSI climbed to 83.1 on July 6. "The Shanghai Composite moves in more or less a similar pattern to the Shanghai A Share Index," he said. Hang Seng declines Hong Kong stocks dropped, dragging the Hang Seng Index to a two-week low, as lower oil and metal prices dragged commodity stocks lower. Property and banking shares declined on concern the government will restrict lending for real estate investment. "We've seen a massive rally with very little correction. People got carried away and are just beginning to be a little bit realistic," said Khiem Do, head of multi-asset strategy at Baring Asset Management (Asia) Ltd. The Hang Seng Index lost 0.8 percent to 17721.07 at the close. The Hang Seng China Enterprises Index dropped 1 percent to 10573.71.

(For more biz stories, please visit Industries)

|

|||||