|

BIZCHINA> Top Biz News

|

|

Layn scrip sizzles hot on bourses

By Wang Ying (China Daily)

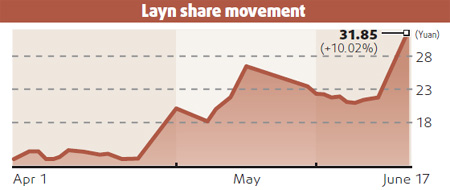

Updated: 2009-06-18 08:09 The outbreak of Influenza A (H1N1) flu epidemic has cast the spotlight on the pharmaceutical, mainly herbal remedies, sector of the Chinese stock market. Star chasers among the hoard of investors around the nation have been pushing up prices of shares of herbal drug makers whose ancient formula were said to contain ingredients that could cure the disease. Although the popularity of many of these hot favorites was short-lived, the furor has refused to dissipate. Even at the height of the craze, few so-called "concept stocks" have rocketed the popularity charts as spectacularly as a little known herbal drug producer from a remote province tucked in the southwest. Trading in the shares of Guilin Layn Natural Ingredients Corp, on the Shenzhen bourse, was suspended for one hour on Tuesday ostensibly to "cool off" after their dramatic rise in the past three trading sessions. The cooling ploy apparently didn't work. As soon as trading was resumed, the company's shares shot up to the daily cap of 10 percent to 28.95 yuan. The drug maker extended its bullish performance yesterday by hitting another daily cap, meaning in two months its market value has increased more than 100 percent.

Layn, a major natural botanical ingredients producer, is located in China's tourism city Guilin in the Guangxi Zhuang autonomous region. It produces over 200 kinds of natural botanical products including Luo Han Guo (siratia grosvenorii, an herbaceous perennial vine) extract, cowberry extract, grape seed extract, grape peel extract, and medlar extract etc. Its annual medicine production is around 3,000 tons with over 95 percent for exports, according to its website. "However, the company's major business has little to do with the flu. The reason for the share price surge is that the Guilin-based company produces a vital ingredient for preventing the wide-spreading flu, or shikimic acid," according to Qu. The Shenzhen-listed company said in the announcement on Monday that it had signed eight contracts for shikimic acid worth 24.17 million yuan since the breakout of H1N1 flu. But Xu Guangfu, an analyst from Xiangcai Securities, said the soaring share price was more driven by market concept than its actual performance and prospects. "We have to say there lie great risks in its trading as its share price is highly volatile. Since April 27, its shares have hit 15 daily caps in 25 trading days," said an analyst who asked not to be named. Xu also cast doubts on the profitability of the eight orders. "Even if its profit margin is 40 percent, Layn could only make around 10 million yuan profit from the 24 million yuan worth of orders, and it can hardly enhance the company's overall performance, considering its straight losses during the first three months," said Xu. Layn reported a net loss of 876,342.77 yuan in the first quarter this year, compared with a net profit of 1 million yuan a year back. Earnings per share (EPS) went down to minus 1 cent, while that for the same period last year was 2 cents. Xu said Layn has almost reached its maximum price. "In spite of the broad rally in recent months, the company has also had two bad days on May 8 and May 26, when it hit the daily down limit." He said there could have been an exodus of hot money during the two days. "We have noticed the unusually huge trading volume at that time," Xu said. Not limited to Layn, the whole pharmaceutical sector saw a high-profile surge in the past few months since the World Health Organization raised the alert degree of the influenza pandemic. Analysts expect the whole industry to pick up in the near future, but not necessarily get a boost, "unless the epidemic spreads across the country", Qu said. As for Layn's performance, analysts hold a conservative view, because the company's share is quite over-valued now. "I would persuade investors to be more cautious, if they want to buy more Layn shares," said Huang.

(For more biz stories, please visit Industries)

|