|

BIZCHINA> Top Biz News

|

|

China may soon join elite club

By Zhou Yan (China Daily)

Updated: 2009-02-18 08:09

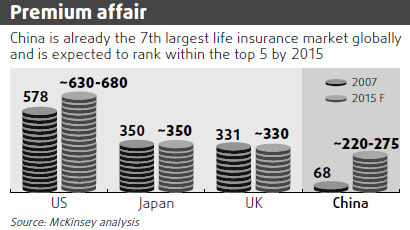

China may soon figure among the top five life insurance markets in the world by 2015 with up to $275 billion gross written premiums (GWP), according to McKinsey & Company. The growth will be driven by the rapid emergence of the middle class, the shift of high savings to investment products, and broader distribution channels.

GWP in the domestic life insurance market is expected to grow annually by 16-19 percent over the 10 years starting from 2007, and expected to touch $220 billion to $275 billion by 2015 from $100 billion in 2008. "We estimate that over the next five to 10 years, 40 percent of the global insurance growth in life insurance will come from Asia, out of which 30 to 40 percent will be from China," said Stephan Binder, director of McKinsey's Shanghai office. The company said that about 50 to 70 million Chinese households will cross the $10,000 annual income threshold to join the burgeoning middle class between 2007 and 2012. They will generate a pool of 100 to 150 million new customers who will buy life insurance for the first time. In addition, McKinsey has forecast that the third-tier cities will see an increase of up to $55 billion in terms of GWP by 2012, compared to approximately 11 percent growth in the first-tier cities. The broader array of distribution channels from the traditional sales force to bancassurance and telesales will also help lift the low penetration of the products, pegged at 2 percent in 2007, Ngai noted. "In the first half of 2008, 40-50 percent of life insurance premiums were sold through banks, up from 25 percent in 2005," McKinsey said. Chinese consumers held 71 percent of their financial assets as cash, down from 84 percent in 2002. Several challenges for insurers under financial crisis, such as waning investor confidence, low profit from bancassurance, and rising competition from domestic predators. "As competition hots up, the 'land-grab' mindset among Chinese insurers is rapidly giving way to a focus on profitability and value creation," Ngai said. (For more biz stories, please visit Industries)

|

|||||