|

BIZCHINA> Top Biz News

|

|

Bank sales drag down index 2.4 percent

(China Daily)

Updated: 2009-01-09 07:41

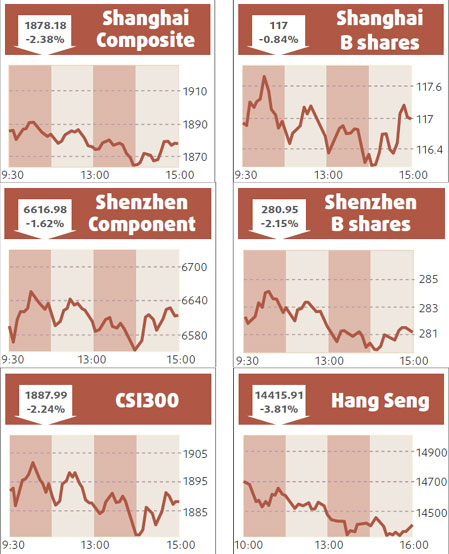

Mainland stocks fell Thursday, led by banks after two high-profile sales of Chinese bank shares in Hong Kong sparked fears of more such selling. The Shanghai Composite Index ended down 2.38 percent at 1878.181 points, off a low of 1862.263. Turnover in Shanghai A shares shrank to a moderate 54.9 billion yuan from Wednesday's 63.7 billion yuan.

Construction Bank's A shares slid 3.88 percent to 3.72 yuan Thursday and Bank of China's A shares dropped 2 percent to 2.93 yuan. Meanwhile, the Shanghai Securities News quoted unnamed sources as saying Walt Disney Co had completed talks with the Shanghai government on plans to build a Disneyland theme park in the city. Shanghai Lujiazui Finance & Trade Zone Development climbed 3.8 percent to 15.85 yuan and Shanghai Wai Gaoqiao Free Trade Zone Development jumped its 10 percent daily limit to 8.69 yuan after the report said their parent groups would take part in building the Disneyland, and an agreement might be announced soon. However, the project has not yet received approval from the central government. Talks on the project have lasted for years, and stocks in Shanghai companies have moved repeatedly in response to rumors about the talks. Telecommunications-related shares continued to slide after the government this week issued 3G licences; the shares had previously risen in anticipation of the announcement. China United Telecommunications slipped 5.97 percent to 4.89 yuan. HSI lower Hong Kong shares closed 3.8 percent lower Thursday as three big Chinese banks tanked, losing $25 billion of their combined market capitalization in a two-day slide. Shares in PC maker Lenovo Group shed more than one-quarter of their value, marking their biggest daily drop in over a decade, after the company warned of a loss for the quarter ended in December and announced an 11 percent staff cut. Lenovo shares, which were suspended on Wednesday, fell 26 percent to HK$1.91 Thursday after having climbed 12.2 percent on Tuesday.

(For more biz stories, please visit Industries)

|

|||||