|

BIZCHINA> Top Biz News

|

|

Weak blue chips pull down index

(China Daily)

Updated: 2009-01-08 07:48

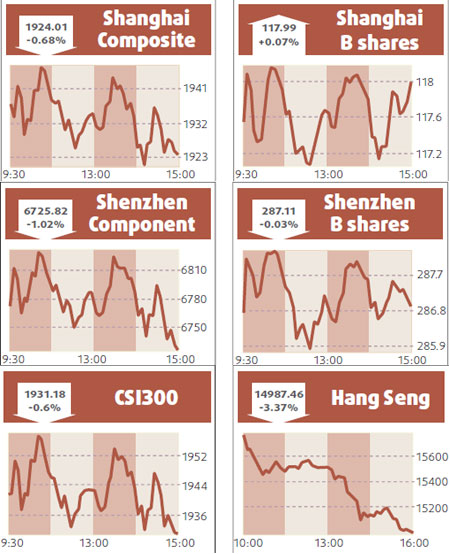

Weak banks and other blue chips pulled down the Shanghai main stock index Wednesday, although many second-tier shares gained in active trade. The Shanghai Composite Index, which had climbed 6.39 percent in the previous two days, closed down 0.68 percent at 1924.012 points. Turnover in Shanghai A shares remained fairly active at 63.7 billion yuan against Tuesday's 68.7 billion. "The market is taking a break after its rally early this week, but it is still likely to touch the 2000-point level in coming days," propelled by hopes that government stimulus steps will start having an impact on the economy in coming months, said Zhang Yanbing, analyst at Zheshang Securities.

Bank of China slipped 1.96 percent to 3.01 yuan. Telecom shares fell back amid profit-taking Wednesday. China United Telecommunications lost 1.89 percent to 5.19 yuan, while equipment maker ZTE dropped 4.03 percent to 27.83 yuan. State-owned water supplier Beijing Capital raced up its 10 percent daily limit to 5.04 yuan after it signed an initial agreement to obtain a loan from Industrial and Commercial Bank of China for an acquisition. It became the first firm to benefit from the banking regulator's decision last month to permit such loans; previously, bank loans could generally not be used for acquisitions. Xiangtan Electric Manufacturing surged 10 percent to 8.99 yuan after saying it had been designated a high-technology firm by Hunan province, allowing it to enjoy a preferential tax rate. HK shares down 3.4% Telecom and bank shares pushed Hong Kong shares down 3.4 percent Wednesday. Turnover swelled to HK$90 billion, its strongest since September 2008, but Hong Kong shares underperformed most regional rivals, which were boosted by hopes for an economic recovery later this year. The Hang Seng Index finished 522.05 points lower at 14987.46 points after testing a three-month high at the open. The China Enterprises Index of top locally listed mainland firms slipped 4.6 percent to 8244.68, weighed down by losses in banking shares. Shares in Semiconductor Manufacturing International Corp gained 2.9 percent after sources said China's top contract chip maker was discussing the possibility of selling a strategic stake to Intel Corp. Shares in power equipment maker Shanghai Electric Group slid 13.2 percent after it cut its net profit forecast for 2008. (For more biz stories, please visit Industries)

|

|||||