|

BIZCHINA> Center

|

|

Related

Retailers shop around for right opportunities

By Zhou Yan (China Daily)

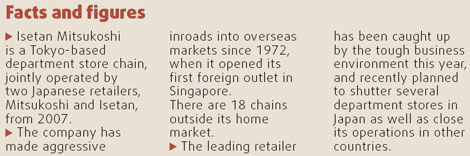

Updated: 2008-10-16 13:44 Many may view the recent announcement by Japanese department store Huating Isetan of its closure in Shanghai as a reprieve from slumping sales, but the market can still be considered to offer rich pickings for other players. The high-end Japanese store, which drew 3.6 billion yen ($34.8 million) at its peak in 1996 during its third year in the city, has seen growth scaled back for several years and posted a straight net loss in 2006 and 2007. Its latest closure marks the shutting of its second outlet in China, following its store in Jinan, Shandong Province, in September last year. Isetan Mitsukoshi Holdings Ltd, the Shanghai outlet's parent company, said that Huating Isetan, the company's first Chinese store, would close in November due to "slumping sales", Japanese wire service Jiji Press reported. Isetan blamed its fall on increasing competition in the industry.

"We once achieved great performance, but sales have plummeted in recent years amid fiercer rivalry from newcomers," said Gao Chaoying, sales manager at Huating Isetan. The company also reportedly failed to reach an agreement with its property owner, Jin Jiang International Shopping Centre, on renewing the rental contract, which will expire this December. Industry insiders said the exit of Huating Isetan is a reflection of the gradually shifting department store landscape in Shanghai. "As the city's department store industry opens wider to the market, foreign brands shoulder similar competitive pressures as local stores ... sluggish rivals will therefore be obsolete if they can't meet customers' greater demands," said Wang Liuhe, secretary general of the Shanghai Merchandise Commercial Profession Trade Association. Facing an overwhelming abundance of choices, Chinese shoppers are eagerly anticipating new shopping malls, focusing more on purchasing experience rather than a one-stop shopping one, said Amy Tan, senior project director from Synovate China. "Customers need more dining and entertainment experience," Tan said. Isetan targeted high-end customers, but it is located in a recreational business district attracting young, and middle-class shoppers, Wang said. Apart from Huating Isetan, other Japanese retail giants like Itokin, Yaohan, and Ito Yokado, are also said to be facing challenges. Unlike other foreign brands, Japanese stores are considered to have less diversified brands of goods in their shops, while the slower pace of decisions being made from the senior level is also thought to hinder the speed at which new products get to store shelves. All key decisions have to go to its headquarters in Japan, which take "quite a long time" before a final one is made, Gao said. Still, the country presents a tempting opportunity for foreign department store operators, as the long-term outlook of the industry remains solid. After a downward correction in 2003, China's department store industry has been back on the fast track, with a 12.6 percent compound growth rate during 2004 and 2007, according to Euromonitor International. It predicts that the market scale will hit 785 billion yuan by 2011. Bolstered by the rise of deposable incomes of the middle-class, along with strong urbanization momentum, China's department store industry is expected to expand and develop further. The income rise of China's new middle class is expected to make the country the third-largest consumer market in the world by 2025, according to recent research from McKinsey & Company. However, analysts point out the industry is far from mature in terms of scale, branding and profitability. "Chinese department stores mainly have strong regional dominance, rather than prevalence in the whole country, therefore brand recognition is quite low at the national level," said Li Xiangfeng, an analyst at Tebon Securities. Dashang Group is considered the major player in North and Northeast China, focusing its efforts in second-tier cities, while Wangfujing seems to focus on first-tier cities, like Beijing. Meanwhile, Brilliance Group dominates first-tier cities in East China, such as Shanghai. "It is unlikely the company (Brilliance) will focus on second-tier cities such as Hangzhou, as local competition is intense," according to a report compiled by Euromonitor. As for international players, Malaysian Parkson of Lion Group outperformed other foreign brands in terms of outlet numbers, the marketing researcher noted. Limited scale restrains its expansion and in return, a small scale leads to lower profitability. "It's hard for store operators to find a balance in between," Li said. Various customer tastes and shopping habits, along with the established loyalty of shoppers for local brands, also set high entry barriers for foreign players. In addition, escalating property prices have forced newcomers to bear extremely higher operating costs - that is why some small-size local outlets can survive, while foreign tycoons have to exit, he continued. Although leading department store retailers are eager to expand, suitable locations are also considered tough barriers. As such, leading department stores are likely to acquire existing outlets of smaller local players with underperforming chains, instead of seeking organic growth from self-managed stores, Euromonitor said. Foreign brands would probably shift their strategies after seeing the many failures of their predecessors in the market.  (For more biz stories, please visit Industries)

|