|

BIZCHINA> Center

|

|

Related

WPP keeps pace with major wealth shift

(China Daily)

Updated: 2008-10-14 11:07

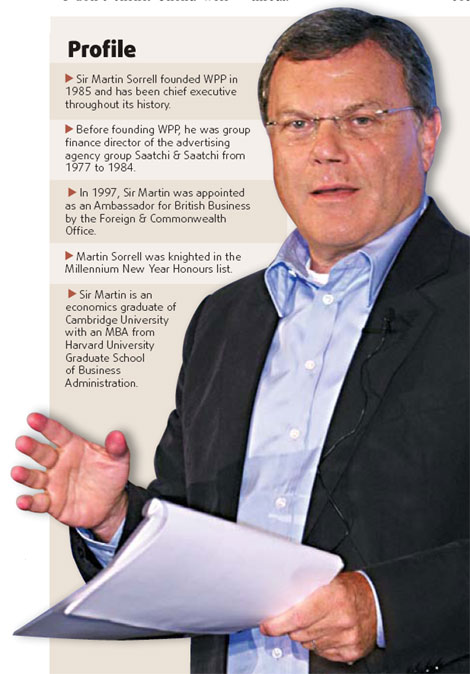

The marketing communications landscape has recently experienced dramatic changes amid technological progress and global wealth shifts. After carrying out a series of hostile acquisitions, WPP Group CEO Sir Martin Sorrell has stunned the world through aggressive expansion across the globe, turning WPP, a company arising from a small wire shopping cart manufacture in 1985, into a communications empire. Its latest hostile move to acquire UK-based market research company Taylor Nelson Sofres PLC for $2 billion, in a bid to build a consulting giant, has just won the approval of the European Union. Sir Martin Sorrell, recently spoke with China Daily reporter Zhou Yan about the company's business strategies, the potential offered by the Chinese market and the firm's long-term ambitions. Q: According to WPP's balance sheet, last year was the strongest ever in your 22-year history. What do you think is the major reason for this robust growth? And what are your company's short-term objectives? A: It's for others to say what we are. Our revenue in 2007 was $12.5 billion, and analysts predict that we would gain $13.5 to $14 billion this year. Currently, about 37 percent of our revenue is from the US, another 37 percent from Western Europe, and the rest from Asia, Latin America, Africa & the Middle East, and Central and Eastern Europe. We've got three objectives: first is to balance the geographical contribution to one third each because of the changing demographics in the world. Asia is roughly half the world's population now, and it will be two thirds by 2014. A tremendous shift is taking place in wealth to the emerging markets largely due to energy prices. Secondly, traditional media is now about 46 percent of our business; and the rest is from non-traditional, which we define as market research, public relations and public affairs, branding identity, healthcare communications and digital direct interactive. We want those non-traditional areas to be two thirds of our business when the cost of traditional network television escalates too quickly, faster than inflation growth. Measurability is our third objective, so direct Internet interactive and market research, which are easier to measure, would become one half of our business rather than the current one third. All in all, all these three objectives can be boiled down to two issues for WPP: geographical development and technological development. Q: WPP is placing greater emphasis on non-traditional business, is this because the sector is more profitable? A: In terms of margins, public relations is quite similar to traditional advertising, market research tends to be lower margin. We've noticed that non-traditional forms are moving more and more into emerging regions, and they're just as profitable as in the West. The biggest area where there is an issue is not for us, but for media owners. Our business is about selling time, but what we've seen in the West is that those companies that are specialized in one medium in one country are finding it increasingly difficult to make money. Q: Do you think the rise of the new media sector indicates a new trend for the advertising business? And how has global economic volatility affected the market so far? A: Today, the Internet is about 10 percent of spending, but consumers spend 20 percent online, so the online ad spend should go to 20 percent to catch up. In Norway and Sweden this year, online spending surpassed the TV sector, making them the first markets in the world. But on a worldwide basis, it still only occupies 10 percent. Here in China, you have 200 million online users, and 25 percent of our business is online already, so we will continue to invest in China's online market. The advertising market has already been affected by the economic downturn; the market has tightened in the West already. We've been slightly affected in the last few months by the slowdown in Western Europe, so our organic growth rate slid slightly to 4.5 percent from 5 percent. But our business has not been affected in China. We forecast the financial market will start to recover in the middle of next year, and the real world recovery will be about six months later. Therefore 2009 will be very difficult, but 2010 will be better. Q: If not for the current crisis unfolding this year, your business growth in the Asia-Pacific and other emerging markets would have already outpaced performance in the West, so your "one third each" goal would not be achieved with many difficulties? A: Yes, it must be. If China's and India's GNP grow at 10 percent, our business is going to grow faster. There's an unwritten rule that our business in emerging markets grows at twice the rate of GNP growth, and much faster than the rate in Western markets, where our business grows along with GNP growth. That's why emerging markets will account for one third of our business. Q: How about competition in the Asia-Pacific region? Is your competitive edge built upon rampant M&A activity in the area? A: We have a three to one advantage in Asia over our competition. Our business in Asia was about $2.9 billion last year, and our biggest competitor was about $1.2 billion. If we acquire Taylor Nelson, that will add another 10 percent to our Asian business. No, our organic growth is very strong here, but we've been also making acquisitions. Q: You once said the Olympics would offer a very positive outlook for your business. Have you reached the goal you set before the Games? A: Yes. I think in China in August, things were little bit slower. At the moment, our business grows faster in India, with 30 percent growth, while China is 20 percent, because when China was preparing for the Games, things slowed a little bit here, but I think we'll pick up again. The big question is that what's going to happen in 2009, and I don't think China will grow as fast, but I don't think it will slow as much as many people think. I don't think China will come under pressure arising from coupling with the rest of the world economy, and the slowdown in the West, because the government's priority is social harmony, and in order to absorb the rural workforce into the cities, the economy has to grow at least 7 or 8 percent. Inflation and labor are the major threat. Q: You've said China probably will become the second largest advertising market, when will this happen? A: It's probably the third now. I forecasted that it will become the second by the Olympics, so I will say in a couple of years time. (For more biz stories, please visit Industries)

|