|

BIZCHINA> Center

|

|

Related

Stock dives confuse investors

By Mao Lijun (China Daily)

Updated: 2008-04-14 11:44 "I am confused," admits Chen Rui, a 32-year-old IT company manager in Beijing, who says he had never thought the stock market would fall this much before the Olympics. "Everyone was saying the market wouldn't fall before the Olympics," says Chen, who mortgaged his apartment to raise 1 million yuan (about $142,857) to buy stocks in 2007. Chen is not alone. Many Chinese investors had thought as much, even though Chinese stocks have been sliding for over three months now. "I hope the market rebounds before the Games. I'll get out when it does," Chen says. Many investors and analysts believe the Chinese economy will maintain strong growth and the stock market will see a bull run before the Games. Historically, host countries' stock markets have gone up around the time of the Games with an upswing in sentiments.

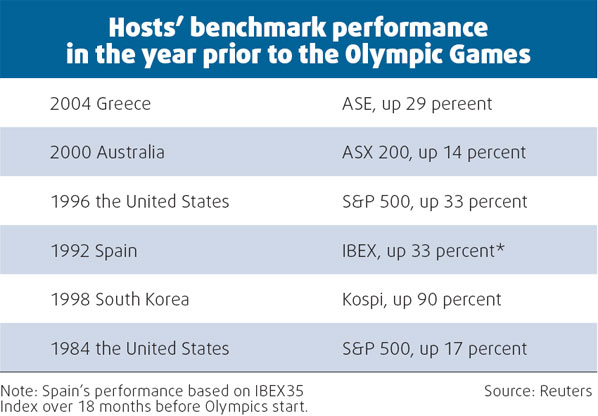

According to a report from Goldman Sachs, stock indices of previous 11 Olympic host countries went up 25 percent on average in the 12 months running up to the Games. Of the six most recently held summer Olympics, the stock markets of all host nations rose and outperformed the global equity market in the year before the Olympics. The best performer was South Korea, which hosted the Games in 1988. The stock index there rose by 90 percent. Those in Greece (2004) rose 29 percent and the United States (1996) rose 33 percent. The average GDP growth of the past 11 hosts was 1.6 percentage points higher than global growth in the two years before the Games, 1.9 percentage points higher in the preceding year and 0.2 percentage point higher in the year of the Games, according to a report from HSBC global research. With China hosting the 2008 Games, the Shanghai stock exchange became the world's best performing major market in 2007. The country's A-share stock index rose by 130 percent in 2007, with Shanghai and Shenzhen indices up by 96.66 percent and 166.3 percent respectively. "Investment, confidence and the attention brought by the Olympics will boost earnings of listed companies," says Zhang Peng, an analyst with Guolian Securities. Analysts see civil aviation, consumer goods, tourism, catering and construction sectors as the major beneficiaries. "Serving the Olympics can help companies in these sectors improve their brand image and boost earnings," says Li Yanling, an analyst with Industrial Securities. Airlines such as Air China, food and beverage companies, breweries, hotel chains, travel agencies and sportswear makers are expected to perform well because of the Olympics, analysts say.  Uncertainties While many Chinese investors and analysts believe the markets will keep rising before the Olympics, dark clouds loom in the horizon. In the first quarter of 2008, the stock market witnessed a sharp fall. Major indices have dropped at a weekly average rate of 5 percent for the past two consecutive weeks. Last Friday, Shanghai's composite stock index closed at 3,492.89, down from a peak of over 6,000 in October last year. (For more biz stories, please visit Industries)

|