Economy

China set for No 1 spot by 2030

By Wang Xiaotian and Zhang Qi (China Daily)

Updated: 2011-03-24 09:34

|

Large Medium Small |

A man passes a real estate advertisement in Shanghai. The World Bank said China will maintain a GDP growth rate of about 8 percent in the coming 20 years. [Photo / China Daily]

World Bank said nation's nominal GDP will equal that of the US in 20 years

HONG KONG / BEIJING - The World Bank's chief economist said on Wednesday that China's economy will probably become the world's biggest by 2030, when it will be twice the size of the United States, if measured in terms of purchasing power parity (PPP).

"China could maintain GDP growth of 8 percent over the next 20 years, which will make it the world's biggest economy," said Justin Lin, senior vice-president and chief economist at the bank. He added that by 2030 the Chinese economy may be approximately the same size as that of the US at market exchange rates in terms of nominal GDP.

Lin made the remarks at the China Economic Development Forum in Hong Kong.

In 2010, China overtook Japan to become the world's second-largest economy. It has set a target of 8 percent for GDP growth for this year. The country is also aiming to record average annual GDP growth of 7 percent in each of the next five years.

Lin said that by 2030, the country's per capita income, measured in terms of PPP, may reach 50 percent of the per capita income in the US.

"It is imperative for China to address structural imbalances, by removing the remaining distortions in the financial, natural resources and service sectors to complete the transition to a well-functioning market economy," Lin said.

The concentration of income in the corporate sector and the wealthier section of society is contributing to the rising disparity in incomes and other imbalances in the economy, he said.

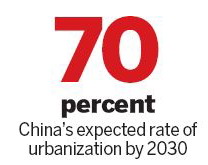

"China still has huge potential to maintain strong growth, as the country's urbanization rate is likely to reach 70 percent by 2030 from the current 47 percent," said Zheng Xinli, vice-president of the China Center for International Economic Exchanges.

Zheng said that the total GDP of Brazil, Russia, India, China and South Africa will account for 47 percent, or possibly more than 50 percent, of the global economy 20 years from now.

"But rising inflation and accelerating capital inflows are prominent problems facing these countries in the short and medium terms, especially China," said Zheng.

| ||||

"The inflation figure will rise to as high as 5 percent in May or June this year, but because of the higher base figure of the second half of 2010, inflation in the second half of this year will cool," Yi said. "So throughout the whole year, we will be able to meet the government's 4 percent target."

Yi said he is "comfortable" with the current level of interest rates, and that raising them excessively would attract "hot money" inflows.

China's consumer price inflation rose to 4.9 percent in January and February from 4.6 percent in December. It hit 5.1 percent in November, a 28-month high. A drought in some major grain-producing areas, together with increases in international grain and oil prices, has led to growing concerns about rising inflation.

To mop up excessive liquidity and help curb increasing inflation and asset bubbles, the central bank has raised reserve requirements for banks nine times since the beginning of 2010, and hiked interest rates in February for the third time since October.

Stephen Green, senior economist with Standard Chartered Bank, said in a research note that the central bank will raise interest rates twice more in the first half, increasing them by 25 basis points each time, and economic growth will slow as a result of tightening measures.

| 分享按钮 |