Latest News

Shenzhen Development Bank's H1 report

(chinadaily.com.cn)

Updated: 2010-08-26 17:25

|

Large Medium Small |

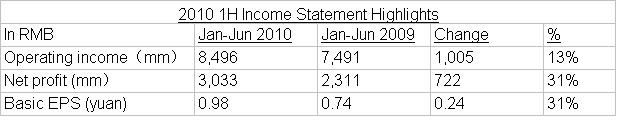

Shenzhen Development Bank Friday filed its 2010 First Half results with SZSE which are posted on the bank's official website www.sdb.com.cn or www.cninfo.com.cn. This press release summarizes the financial highlights and management analysis for 2010 1H report attached with highlights of income statement.

In 2010 1H, interest earning assets of the bank improved steadily, asset quality maintained stable, spread in 2Q improved slightly from last quarter, fee business achieved robust increase and overall profitability realized good YOY growth. Highlights are as follows:

- Net profit in the first six months of 2010 recorded 3.03 bn Yuan and EPS recorded 0.98 Yuan, both up 31% over the same period of last year.

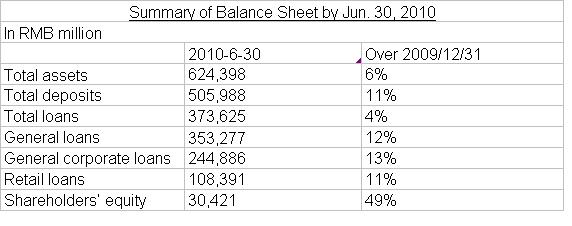

- By the end of Jun 2010, compared with yearend 2009, total assets reached 624.4 bn Yuan, up 6%; general loans grew 12% to 353.3 bn Yuan; total deposits increased 11% to 506 bn Yuan.

- Asset quality maintained stable: By end of 1H, NPL was 2.29 bn Yuan and NPL ratio 0.61%. Provision coverage ratio atJune 30 further increased from 188% at end 1Q to 224%.

- The bank completed its Non Public Offering ("NPO") to Ping An Life Insurance Company of China, Ltd ("PA Life") in Jun 2010 and raised about 6.9 bn Yuan in total, remarkably raising the Capital Adequacy Ratio ("CAR") to 10.41% and Core Capital Adequacy Ratio ("CCAR") to 7.20%.

- The bank continued investment into information system, human resources, process optimization, business strategy and other aspects.

Good YOY profit growth

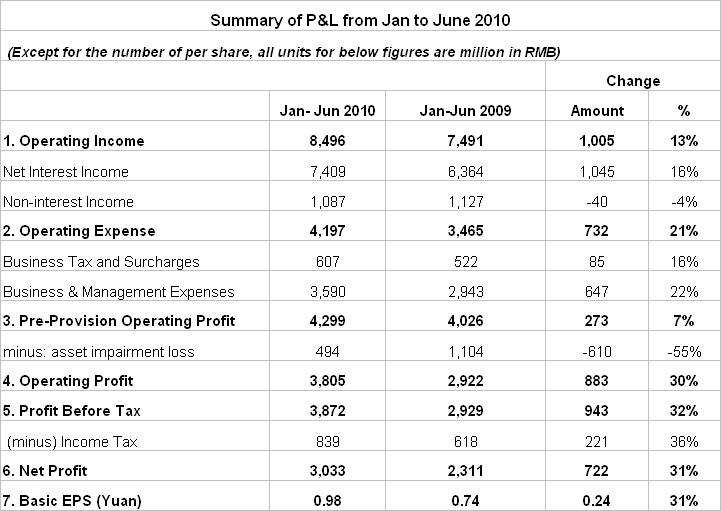

In the first half, thanks to sound scale growth and balance sheet management, the bank achieved 8,496 mm operating income, up 13% YOY, and 3,033 mm net profit, up 31% YOY.

In 2010 1H the average interest earning assets grew 19% YOY, net interest margin ("NIM") was 2.46%, 5 bps less than the same period of last year, and net interest income grew 16% YoY to 7,409 mm Yuan. The impact on spread from consecutive interest rates cuts by the PBC since 2008 has been completely digested up to date, with rates and yields maintained at a steady level. In the first half, the net commission and fee revenue rose significantly by 57% YOY to 750 mm Yuan; net investment gains dropped 66% YoY primarily due to large bond gains of 430 mm Yuan from taking advantage of market opportunities in 2009 1H. Operating income grew 13% YoY to 8,496 mm Yuan.

The first half saw 22% YOY growth of operating expense mainly due to growth of staffing and business scale as well as investment in management process upgrade and IT systems. The cost to income ratio (excluding business tax) in the reported period was 42%, up 2.97% YOY. Asset impairment provisions in 1H were 494 mm Yuan, down 55% YoY, thanks to continuously solid asset quality.

The annualized return on average equity (ROAE) for the first half was 25.81%, up 1.11% YoY. Basic EPS was 0.98 Yuan, up 31% YoY. In Jun 2010, the bank completed NPO to PA Life of about 380 mm new shares and by Jun 30, 2010 total shares of the bank increased from 3.105 bn shares at end of last year to 3.485 bn shares.

Reinforced key business advantages to achieve good growth

In 1H all assets and liabilities of the bank grew well with more optimized balance sheet structure. By Jun. 30, 2010, compared with end of last year, total assets of the bank increased 6% to 624, 398 mm Yuan; total general loans (not including discount) increased 12% to 353,277 mm Yuan; total deposits increased 11% to 505,988 mm Yuan. Shareholders’ equity increased 49% to 30,421 mm Yuan over end of last year thanks to profit contribution and 6.9 bn Yuan raised capital through NPO. Liquidity of the bank remained in a good state. At end Jun. 2010, liquidity of the bank was higher than regulatory requirement,at 43.9%. The bank monitors liquidity through this ratio and other internal indicators.

In 1H corporate banking business grew steadily. Liabilities structure was optimized by vigorously development of products and channels that were beneficial to growth of liabilities business. In addition, online supply chain financial system project went ahead smoothly and the bank has finished connection with systems of main cooperating enterprises. By end Jun. 2010, compared with last yearend, corporate deposits grew by 11%, general corporate loans by 13%, and SMEs RMB loans by 14% to 128.2 bn Yuan. Net fee income from corporate business in the first six months in 2010 increased 21% YOY. In 1H 2010, the trade finance business grew steadily, with trade finance lending up 19% in 6 months to 145.4 bn Yuan. Trade finance lending in 2Q increased faster than in 1Q with good asset quality maintained. NPL ratio of trade finance by end Jun was 0.35%.

In retail business, the bank made great efforts in improving overall customer loyalty, sales capacity and fee income. By Jun. 30, 2010, compared with end the last year, personal loans (including credit card) increased 11% to 108.4 bn Yuan. NPL ratio of personal loans ( excluding credit card) was 0.21%, down by 12 bps from end last year. Effective credit card in force was 3.92 mm with credit card lending NPL ratio at 1.23% at 06/30/2010. In 1H 2010, sales volume of wealth management products increased by 427% to 33.7 bn YOY. In 1H 2010, automobile loans grew strongly, with 3.7 bn new loans disbursed, up 70% YOY.

Asset quality stable and CAR met standard

In 2010 1H, in light of national macro control policy and risk reminder from regulators, the bank actively adjusted credit policy, further optimized credit structure, strictly managed new loan risks, strengthened collection and disposal of existing non-performing loans, and took active advance measures against loans with early warning signs.

By Jun. 30, 2010, the NPL of the bank was 2.29 bn Yuan, 152 mm Yuan less than end of last year. NPL ratio was 0.61%, down 7bps from end of last year. In 1H 2010, the bank collected 1.68 bn Yuan non-performing assets in total (including written-off and non written off bad loans), among which were 1.46 bn Yuan principals . In addition, the bank has been implementing prudential credit policy on real estate development loans and strictly controlling disbursement of real estate development loans in light of requirements from government and regulators. Until Jun. 30, 2010, real estate development loan balance of the bank was 14.1 bn Yuan, accounting for 3.76% of total loan balance, among which NPL amount was 191 mm Yuan and NPL ratio was 1.36%. Real estate development loans made after 2005 have no bad loans.

In 2010 1H, the bank launched NPO of 379,580,000 shares to PA Life at RMB18.26 per share, raising 6.931 bn Yuan in total and after issuance expense, 6.907 bn net amount was added to the bank’s core capital. Core capital brought about by the issuance as well as profit generation lifted CAR and CCAR of the Bank to 10.41% and 7.20% respectively as of June 30, 2010, which met regulatory standard for the first time.

Outlook for 2nd Half

For 2010 2H, the bank will continue prudent operation, consolidate business foundation, improve risk management, implement credit portfolio management for different business structure, undertake differentiated customer management while pursue business development, strengthen advantages in SME and trade finance business. The Bank will enhance compliance, audit and operation management to ensure that the bank’s overall business keeps healthiness and compliance. In the mean time, with the entry of PAG as a strategic shareholder, the bank will achieve higher in respect of financing capacity, business innovation, customer base, and infrastructure, and this will help to improve the bank’s capability in providing full-range financial services.

About SDB

SDB is the first joint-stock firm listed on the Shenzhen Stock Exchange (000001 SZSE). As a national bank headquartered in Shenzhen, its total assets reached RMB624.4 bn as of June 30, 2010. Through 303 outlets in 20 cities nationwide, SDB provides diversified financial service to its corporate, retail and public sector customers. Currently, Ping An Insurance (Group) Company of China, Ltd and its related subsidiaries hold 1.045bn shares of SDB, accounting for around 29.99% of SDB post-NPO total equity.

Key items on the balance sheet as of June 30, 2010:

- Total deposits: 506 bn Yuan

- Total loans: 373.6 bn Yuan

- Total asses: 624.4 bn Yuan

Media enquiry:

Sophie Yu: +86 755 2216 8455

Candy Bai: +86 755 2216 8191

Investor enquiry:

Audrey Huang: +86 755 2216 6285

Yvonne Wang: +86 755 2216 8802

SDB 1H 2009 financial statements were audited by E&Y, pursuant to the Chinese Accounting Standards. All data shown in this press release were audited.