Companies

Finding a Gap in the market

(China Daily)

Updated: 2010-12-27 10:59

|

Large Medium Small |

Online sales

Online retail sales in China, which has the world's largest web population of at least 420 million, soared 117 percent last year to $39 billion, according to iResearch, a Shanghai-based research firm. That's the reason why so many retailers use Internet platforms to grow in the emerging market.

Italian fashion designer Giorgio Armani launched an online store in China in November and told Agence France-Presse that it was "the first fashion brand to offer a 'flagship store' online experience in China".

Zhao Ping, a professor at Beijing Institute of Fashion Technology, said online sales were the trend for the clothing industry and developing a buying habit was very important.

"Online clothing sales are promising, accounting for almost 60 percent of all apparel sales in China," said Zhao. "Gap can take advantage of this channel to promote its brand."

Zhao also said China's biggest online apparel retailer, Vancl.com, was fostering loyal consumers but had not realized a profit. However, it would pay off when people adapted to that way of shopping.

According to Bloomberg, sales of Vancl will triple to 20 billion yuan ($3 billion) in 2010 as more people in the world's largest Internet market go shopping online.

Yue Sanfeng, a partner at Hejun Consulting company, said Gap should speed up to enhance brand awareness, otherwise many small companies could seize the market using lower labor costs and imitating successful lines.

|

||||

"Under pressure from high housing and car prices, many middle-income people would rather choose cheaper clothes, only buying a luxury item after saving money for a long period of time," said Yue.

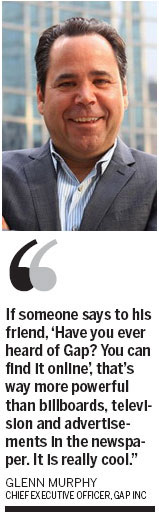

Murphy added that the global specialty apparel retail industry was highly competitive and its first month of booming business will not guarantee its future popularity in China. But he said the company was determined to enter China.

"It's a huge market, and we are sure to expand new stores in Hong Kong next year," Murphy said. "An online store will be opened in advance for promotional purposes."