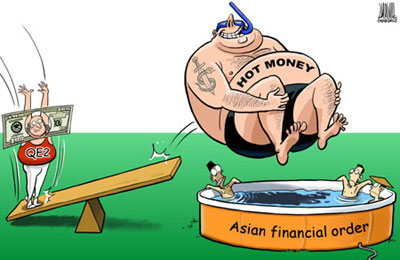

Editor's note: China's central bank raised the reserve requirement ratio by 0.5 percentage points on Dec 10, rather than hiking the benchmark interest rate, to curb inflation. Analysts attributed the central bank's cautious policy to two main factors: the uncertainty lingering on China's economy next year and the worry about more hot money inflow. It seems hot money will continue to be a "hot issue" in China.

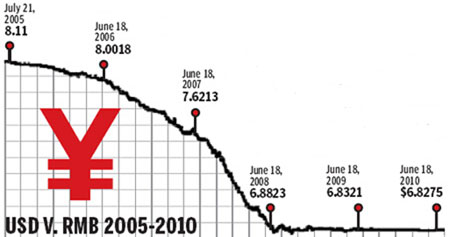

Yuan appreciation

China to further reform RMB exchange rate regime

The People's Bank of China, China's central bank, has decided to proceed further with the reform of the Renminbi exchange rate regime to enhance the RMB exchange rate flexibility, a spokesperson of the central bank said on June 19. [Full Story]

China to continue RMB exchange rate reform

Chinese President Hu Jintao reiterated in May that China will continue to steadily advance the reform of the formation mechanism of the RMB exchange rate under the principle of independent decision-making, controllability and gradual progress. [Full Story]

Special coverage: China Advances Yuan Rate Reform

Special coverage: China Advances Yuan Rate Reform

Rates hike expectations

Inflation expectation presses for rate hike

The possibility of an interest rates hike by China's central bank is imminent as inflationary pressure prolongs and a "prudent" monetary policy is in place, the China Securities Journal reported on Dec 10. [Full Story]

Interest rate hike of 25 basis points announced

The central bank on Oct 19 raised interest rates for the first time in nearly three years in an attempt to combat inflation and soak up excessive market liquidity.

The People's Bank of China said it was raising benchmark rates by 25 basis points, taking one-year deposit rates to 2.5 percent and one-year lending rates to 5.56 percent, effective on Oct 20. [Full Story]

Analysts see rate hikes

Ma Jun, chief economist of Deutsche Bank Greater China, Ma raised his forecast for rate hikes to 75 basis points in the coming 12 months from an earlier projection of 50 points, and expected the yuan to appreciate 5 percent against the US dollar in the coming 12 months, one point higher than the earlier projection of 4 percent. [Full story]

Zhou Wangjun, senior official in charge of price at the National Development and Reform Commission, said interest rate hikes cannot be ruled out", "We have entered an interest rate hike cycle." [Full Story]

"Speculation on interest gain from the renminbi will lure more hot money from US investors, who are keen to divert their money from the low-rate US dollar," said Feng Ke, director of Peking University's financial properties research center. [Full Story]

US monetary policy

US new monetary policy poses challenges to China

Special coverage: Fed's QE2 sparks concerns

Special coverage: Fed's QE2 sparks concerns

FDI growth & inflation rise

Foreign direct investment (FDI) into China rose for the 15th consecutive month in October, evidence that China remains a favored investment destination for foreign businesses.

Inbound FDI increased 7.86 percent year-on-year in October to $7.663 billion. The October figure means inbound FDI for the first ten months of the year totaled $82.003 billion, a year-on-year increase of 15.71 percent. [Full Story]

China's consumer price index (CPI), a major gauge of inflation, rose to a 28-month high of 5.1 percent in November, the National Bureau of Statistics (NBS) said on Dec 11. [Full Story]

Special coverage: China Economy by Numbers

Special coverage: China Economy by Numbers

Hot money waiting to enter Chinese mainland from HK

A huge amount of international speculative capital, or "hot money", is waiting to enter the Chinese mainland from Hong Kong, Shanghai Securities News reported on Nov 26.

Wen Tianna with the Hong Kong Security Association said that unofficial statistics showed that a total of HK$650 billion worth of hot money is awaiting opportunities to enter the Chinese mainland market.

Wen said hot money inflows have been increasing since August, at a speed of a nearly eight-year high. [Full Story]

|

|

|

|

|

|

Hot money withdrawn from the agriculture futures market in November. |

Believed to have much better yields than ever before in September. |

Once beat gold as the best asset. |

Favored by hot money spenders in May this year. |

|

|

|

|

|

Gold |

Relatively low stock prices now may attract hot money. |

Hot money is blamed for unaffordable housing prices in China. |

Great art continues to inspire buyers and generate high prices. |

SAFE vows crackdown on 'hot money' inflows

China's foreign exchange regulator, the State Administration of Foreign Exchange (SAFE), said on Oct 12 it will continue to stop inflows of speculative money, or "hot money," into China and crackdown on illegal foreign exchange activities.[Full Story]

More stories:

SAFE to monitor hot money flows

SAFE to monitor hot money flows

China to continue to fight hot money inflow: SAFE

China to continue to fight hot money inflow: SAFE

SAFE says China faces pressure to curb abnormal capital inflow

SAFE says China faces pressure to curb abnormal capital inflow

China uncovers $7.3b fraudulent FX deals

China uncovers $7.3b fraudulent FX deals

China vowed to increase efforts to combat inflation while maintaining "stable and relatively fast" economic growth, as consumer inflation hit a 28-month high of 5.1 percent in November.

"The priority is to actively and properly handle the relations between maintaining steady and relatively fast economic growth, economic restructuring and managing inflation expectations," according to a statement released after the high-profile Central Economic Work Conference.

The conference also reaffirmed the recently introduced "prudent" monetary and pro-active fiscal policy for 2011. [Full Story]

Special coverage: 2010 Central Economic Work Conference

Special coverage: 2010 Central Economic Work Conference

PBOC urges lenders to vet yuan trade settlements

China's central bank has urged lenders to strengthen verification of cross-border trade settlements in yuan, as part of efforts to curb hot money inflows, the Securities Times reported on Dec 3, citing Fan Linchun, an official of the Guangzhou branch of the People's Bank of China. [Full Story]

More stories:

China to increases yuan-settlement companies

China to increases yuan-settlement companies

China issues new rules on RMB settlement accounts

China issues new rules on RMB settlement accounts

Cross-border yuan trade to boost liquidity

Cross-border yuan trade to boost liquidity

China expands pilot program of yuan settlement

China expands pilot program of yuan settlement

Changes aimed at cooling the flow of 'hot money'

Foreign institutions with a presence in China will only be allowed to buy commercial property for their own use and it must be in the city in which they are registered.

The Ministry of Housing and Urban-Rural Development and the State Administration of Foreign Exchange have issued a notice outlining the rules that will also only allow foreign citizens living in China to buy one home for their own use, Shenzhen-based Securities Times reported in November, citing unnamed sources. [Full Story]

Special coverage: China's Real Estate Curbs

Special coverage: China's Real Estate Curbs

'Hot money' controllable

China will be able to keep inflows of speculative capital under control even if the latest clarifications on its yuan policy trigger any influx of "hot money", Yongding, a former member of the central bank's monetary policy committee, has said.

"But we should not panic and stop allowing the yuan to get more flexible simply because of that(inflows of speculative capital); we can keep it under control by enhancing cross-border capital control," Yu, who is also head of the China Society of World Economics, told China Daily. [Full Story]

Easing of hot money 'unlikely'

|

|

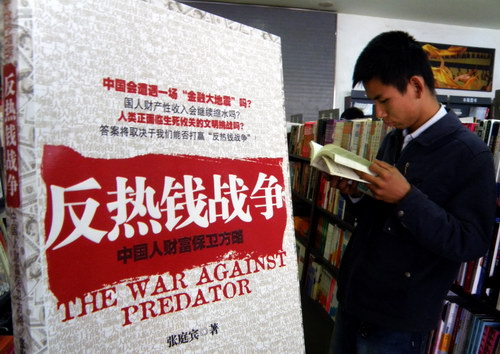

A customer reads a best-seller, The War Against Predator, in a Xinhua Bookstore in Yichang, Hubei province. China has become one of the most attractive destinations for speculative money. [Photo / China Daily] |

China's foreign exchange regulator has vowed to crack down on illegal cross-border capital flows, but analysts said the pressure from the influx of speculative money is unlikely to ease. [Full Story]

China has curbed hot money inflows

China has made some progress in combating illegal flows of speculative capital and at present is not facing a large influx of hot money, the country's foreign exchange regulator said on May 25. [Full Story]

Regulator plays down hot money fears

The $453 billion increase in China's foreign exchange reserves last year partly reflected currency valuation effects and was not solely due to inflows of "hot money", the State Administration of Foreign Exchange (SAFE) said on Jan 19. [Full Story]

Produced by Song Jingli and Ren Jie