Statistics

Rise in imports helps shrink trade surplus

By Ding Qingfen (China Daily)

Updated: 2010-12-11 09:07

|

Large Medium Small |

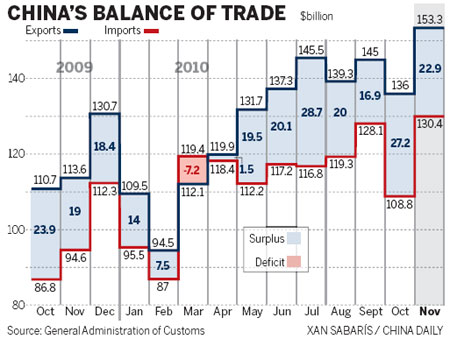

BEIJING - China's trade surplus in November shrank compared to the previous month but was still around $23 billion, with imports and exports both hitting record highs.

Economists said the nation's surplus is likely to go on shrinking in the long term, even though it may remain above $20 billion for a while, suggesting China should resist pressure from some countries to allow its currency to rise sharply.

The latest figures were in line with policymakers' efforts to ensure the country's economic growth is balanced and were released as the three-day Central Economic Work Conference kicked off on Friday. The session will set the tone for next year's economic policymaking.

The nation has decided to make its foreign trade more balanced with more measures taken to increase imports. Top commerce officials expect the trade surplus to fall next year, which analysts said will help alleviate outside pressure for yuan appreciation.

China's exports and imports last month hit monthly record highs, with year-on-year growth rates reaching 34.9 and 37.7 percent respectively.

And it was the fast growth in imports that led to the contracting of the trade surplus to $22.9 billion in November from the $27.2 billion it was in October.

Exports were slightly stronger than anticipated.

"The most important reason (for the growth in exports) may be the stronger-than-expected import demand from the United States and other advanced economies," said Wang Tao, head of China economic research with UBS Securities.

As for the rise in imports, the "growth in commodity and machinery imports were much stronger in November," she explained.

China's imports of soybeans jumped by 47 percent in November, the first gain in five months, and copper imports rose by 29 percent, the first rise in three months.

"The growths were far beyond our expectations and they were probably driven up by hot money. So, China should consider slowing down the yuan appreciation," said Dong Xian'an, chief economist with Industrial Securities.

China's yuan gained 0.1 percent in November and 0.3 percent in October, after it grew by 1.7 percent in September.

A Ministry of Commerce spokesperson said recently that China's trade surplus will shrink gradually as imports expand sharply at a time when the growth of exports is expected to decelerate.

"The long-term trend is that the trade surplus will narrow but in the short-term, there are many uncertainties," said Zhang Yansheng, a senior researcher on trade at the National Development and Reform Commission, China's top economic planning organization.

Song Hong, director of the department of international trade under the Chinese Academy of Social Sciences, agreed.

"It takes time to change China's foreign trade structure under which 'processing trade' is the major source of the surplus," he said. "And this decides that China's trade surplus will remain at between $20 billion and $30 billion for quite a time."

But "this does not mean China should submit to the demands from outside for yuan appreciation. The appreciation should be gradual."

| ||||

China's customs agency said on its website that "foreign direct investment is the major source of China's trade surplus".

But foreign nations have been blaming China's currency policies for the trade surplus and have demanded that Beijing take bigger steps to ensure the yuan appreciates.

US Senate Foreign Relations Committee Chairman John Kerry said on Tuesday that the US Congress was growing impatient with China over what it sees as currency under-valuation and may take action next year.

During the China-US Joint Commission on Commerce and Trade meeting, which will be held on Dec 14 and 15 in Washington, the US is expected to raise the currency issue. And, when Chinese President Hu Jintao visits the US in January, currency is also likely to be a hot topic during bilateral meetings.

"But there is no direct link between surplus and currency policies," said Zhang. "The US must find out the truth before it can pressurize China, otherwise, its arguments make no sense."

The Ministry of Commerce said on its website on Friday that China is "not hopeful" about its exports for 2011 because the "world economic recovery has been quite slow, trade protectionism against China has been strengthened and the cost of raw materials and labor has been rising."

Experts said the US and EU, with their high unemployment, low GDP growth and huge debts, will continue to blame China for their economic problems.