Money

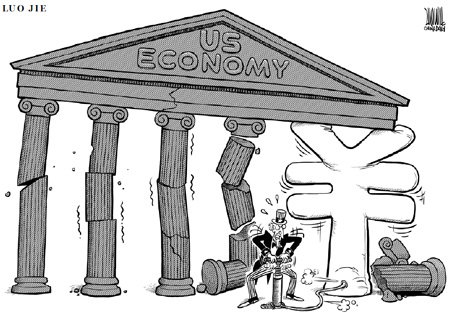

Fast yuan revaluation no panacea - top banker

(Agencies)

Updated: 2010-10-11 10:54

|

Large Medium Small |

WASHINGTON - Demands that China rapidly revalue its yuan currency are akin to seeking a magic cure to a problem that requires a slow-working, herbal remedy, the country's central bank governor, Zhou Xiaochuan, said on Sunday.

Beijing realizes it must raise the value of its currency, but the strength of the yuan depends on carefully gauging economic fundamentals like inflation, growth and employment, said Zhou, the head of the People's Bank of China.

|

Governor of People's Bank of China Zhou Xiaochuan (L) attends the annual IMF-World Bank meetings plenary session in Washington October 8, 2010. [Photo/Agencies] |

"China would like to use more gradual ways to realize a balance between domestic and external demand," he said, repeating the message he drove home at the weekend's International Monetary Fund (IMF) meetings.

Zhou, speaking to a seminar on the sidelines of the IMF gathering, used a metaphor of the differences in medical practices in the East and West to highlight the challenges faced in addressing the currency debate that has pitted the United States and other industrialized countries against China.

"In China, a lot of people believe in Chinese doctors. In Western countries, they believe in Western-trained doctors," he said.

Zhou and his deputies pushed back at the IMF meetings against a chorus of pressure for China to let the yuan rise further and more rapidly than the roughly 2 percent gains seen since June 19, when Beijing loosened the yuan's peg to the US dollar.

Many US lawmakers, labor unions and manufacturing groups believe China deliberately keeps the yuan, also called the renminbi, undervalued to keep Chinese exporters in business.

The US House of Representatives last month stepped up pressure on China to let the yuan rise more quickly, passing a bill just weeks before US congressional elections on November 2 that would provide new muscle to combat "undervalued currencies" by allowing the the imposition of tariffs on goods.

Zhou earlier told reporters during the IMF meetings he believed the currency issue might "gradually fade out along with the recovery" of Western economies and job markets.

"For China, we have a package to enhance the internal demand including ... consumption, social security system reform, new investments in the rural areas," he said.

These measures, he told reporters, show "that China sincerely wants to bring the current account surplus down to a reasonable level."

China faces trade-offs between its economic fundamentals and trade surpluses, Zhou said.

"It is quite a complicated art to perform, but if we successfully keep low inflation... the yuan is going to be stronger," he said.

|

|