InfoGraphic

Ventures abroad facing a bumpy road

By Zhu Xiaoming�61nd Pedro Nueno (China Daily)

Updated: 2010-09-06 11:02

|

Large Medium Small |

|

|

|

Zhu Xiaoming, executive president and professor of management at CEIBS. |

Pedro Nueno, president and professor of entrepreneurship at CEIBS |

SHANGHAI - With the rapid growth of China's economy and its fast-paced integration with the global market, "Chinese companies going global" has suddenly become a hot topic. As they venture abroad on what will surely be a journey full of twists and turns, Chinese companies will not only face global competition and external pressure, but they will also have to significantly improve their management skills at the internal level.

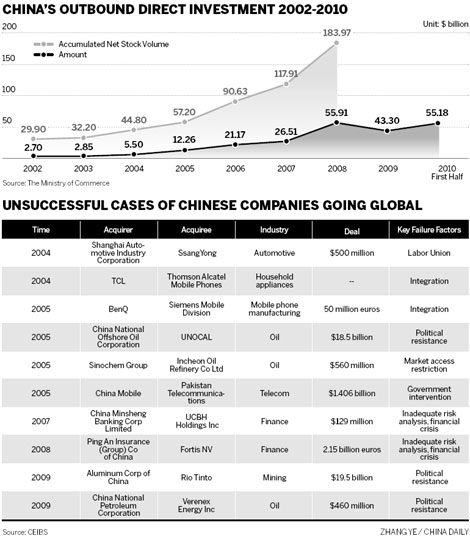

In 2005, for example, China National Offshore Oil Corporation (CNOOC) made a bid to acquire UNOCAL - one of the largest US-based oil companies. However CNOOC ultimately withdrew its bid after the US Congress expressed doubt about the State-owned Chinese oil giant's acquisition intentions. Even as the financial crisis battered the global economy, this type of resistance has kept cropping up.

Then, at the beginning of 2009, Rio Tinto refused a tender offer from Aluminum Corporation of China (Chinalco), undeterred by even a $195 million penalty for breach of contract. And recently, China has come under fire from some countries' media concerned about the country's announced intention to invest in Greece in an effort to help the debt-laden country emerge from the financial crisis.

China's rise has sparked some fears about Chinese companies' international expansion. However, this doesn't mean that Chinese companies can do nothing but wait until these sentiments abate. One possible strategy would be for Chinese companies to set their sights on becoming minority shareholders in foreign companies, rather than aiming for controlling shares. This approach is already being successfully used by China Investment Corporation. Another option is for China's privately-owned companies to become the driving force behind the country's efforts to go global. One of the latest examples is Geely's acquisition of Volvo.

The country's economic success in past years often overshadows the fact that Chinese companies still have a very short history. In fact the typical Chinese company, such as Lenovo and Haier, can only trace its origins back to the mid-1980s. The relative infancy of these firms, combined with China's late start in management education, means that Chinese companies have to "cross the river by feeling for stones", and learn how to manage through practice and frequent reflection. Therefore, there is an urgent need for them to 'catch up' by acquiring systematic management knowledge.

While many Chinese companies are agile and have lofty ambitions, some of them lack the efficient management systems and processes needed to implement their goals. China's imperfect institutional environment and rapidly changing marketplace entice many domestic companies to rush to take advantage of "opportunities" without careful analysis.

This can create problems, at the integration stage, for Chinese companies that invest in companies from abroad.

Another challenge comes from Chinese firms' comparatively limited experience in cross-cultural management. Although they have accumulated a lot of knowledge from their export activities, their main businesses are still located in China, and international staff members make up a very small percentage of their workforce. Their management teams are also unskilled in cross-cultural management.

To fill these gaps and overcome these hurdles, business schools in China have an important role to play in facilitating Chinese companies' efforts to go global. In 1994, the Chinese Government and the European Union had the foresight to jointly establish the China Europe International Business School (CEIBS) with the stated mission of "nurturing management talents capable of competing in the global market".

Over the years, the school has assembled a team of international faculty members, with a large majority of CEIBS professors obtaining their PhDs from world-renowned European and US-based universities or business schools. And up to 40 percent of CEIBS' MBA participants come from outside China. In program design, career development, teaching methodologies and its campus design, CEIBS meets or exceeds international standards. Designed by Pei Cobb Freed & Partners and IDOM, leading architectural firms from the USA and Europe, respectively, CEIBS' Shanghai and Beijing campuses are cradles where management talents are nurtured with a combination of international perspectives and cross-cultural management skills.

CEIBS, by its very nature as a dual-continent collaboration, also offers valuable lessons on how to succeed on an international level. Over the years, we have learned, for example, that respect for each other is one of the factors critical to the successful integration of a multicultural team. Any major international business decision will have many variables, can be seen from different perspectives - and there is always some degree of uncertainty.

Past experiences in different cultural settings may suggest a certain line of action; but humility, respect for others' opinions and a willingness to work as part of a team to build on what others see as key points, may lead to a rich and flexible action plan that garners a lot of support during implementation. An integrated team of strong leaders who respect each other will focus their time and energy on working towards common goals, inspiring the rest of the organization to do the same.

Through joint ventures and alliances, both sides' resources and advantages can be fully leveraged; but potential areas of cultural conflict should be addressed. Many managers want to be in full command; but joint ventures and alliances may require that they learn to listen, not just lead. There will also be a need for greater attention to strategy and implementation - and the willingness to learn from each other. Successful joint ventures, alliances and acquisitions can be excellent ways to enter the global markets but they require the capacity to create winning multicultural teams. Fortunately, the values needed for a successful organization transcend national borders and are truly global: ethics and transparency, hard work, treating employees as individuals who crave opportunities for self-development and growth, responsibility towards society, generosity, mutual respect, and enthusiasm.

Zhu Xiaoming is executive president and professor of management at CEIBS. Pedro Nueno is president and professor of entrepreneurship at CEIBS.