Biz Unusual

Luxury brands wrest back China market

(Agencies)

Updated: 2010-08-07 16:59

|

Large Medium Small |

|

|

|

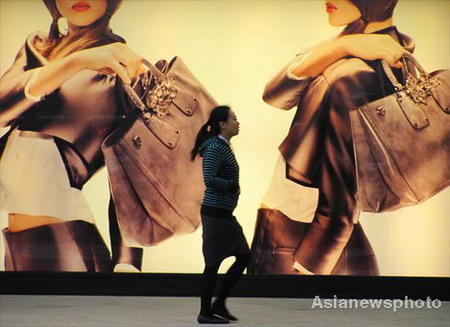

A pedestrian walks by an ad of a luxury brand in Beijing on April 5, 2010. [Photo / Asianewsphoto] |

HONG KONG - Top global luxury brands like Burberry and Coach are pouring funds into China's multi-billion dollar luxury market, wresting control of their brands from Chinese partners as they swoop back into a market set to become world No 1.

Many piled into China over the last decade, pairing with re-sellers and joint venture partners, but with so much at stake, they are severing these ties and bringing their own considerable financial and marketing muscle as well as expertise to China.

In July, Burberry said it plans to buy its network of 50 China stores in 30 cities, now operated by its franchisee, for 70 million pounds ($107.5 million), a deal seen as adding up to 20 million pounds to its 2011-12 operating profit.

French handbag maker Longchamp has decided to buy out its Chinese distributor, and has assembled a Chinese team to take care of administrative tasks. Polo Ralph Lauren has also bought back China distribution right from Dickson Concepts.

"This is definitely a trend for luxury brands to operate in China themself," said Marie Jiang, retail analyst from Pacific Epoch, a China focused advisory firm.

|

||||

China is now the world's No 2 luxury goods market, with sales up 12 percent in 2009 to $9.6 billion, accounting for 27.5 percent of the global market, according to consultancy Bain & Co.

The figure is expected to grow further to $14.6 billion in the next five years, making it the world's top luxury market.

"Many of them gained experience after more than a decade of operation in the mainland, and are ready to roll over to the next phase of development of operating on their own, so they can reduce the distribution cost and raise the operating margin," said William Lo, an analyst at Ample Finance.