Money

Tin reaches highest level since Lehman failure on stockpiles

(China Daily)

Updated: 2010-07-28 09:46

|

Large Medium Small |

SHANGHAI - Tin, the best performing industrial metal this year, climbed to the highest level since the collapse of Lehman Brothers Holdings Inc in September 2008 as shrinking inventories signaled steady demand.

The metal for three-month delivery advanced as much as 2.1 percent to $19,800 a metric ton on the London Metal Exchange, and traded at $19,500 at 1 pm in Shanghai. That's the highest intraday price since Sept 3, 2008, before Lehman's failure triggered a credit-market seizure and global recession.

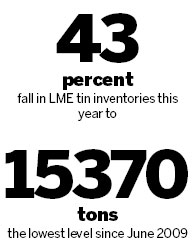

LME inventories of the metal used in packaging, solder and cans have shrunk 43 percent this year to 15,370 tons, the lowest level since June 2009.

A rally in equity markets, declines in the dollar and optimism that the economic recovery remains intact helped an index of London-traded metals to post the biggest weekly gain since February last week.

"The contractions in stockpiles underline improving demand against supply," said Ran Jun, an analyst at researcher Beijing Antaike Information Development Co.

Demand for tin products and electronics has recovered a lot from Western countries this year, Ran said.

Exports of tin from Indonesia, the world's largest producer, dropped 16 percent this year through May compared with the same period last year, Barclays Capital said on July 13. Outbound shipments fell 25.7 percent in June from a year ago, according to Indonesia's trade ministry.

| ||||

"From the demand side there is an increase because production of electronics, which account for about 60 percent of demand, is rising," he said.

Tin's rally has boosted the shares of producers. Yunnan Tin Co, China's largest producer, has jumped 22 percent this month while the benchmark CSI 300 Index has risen 9.3 percent. PT Timah, Indonesia's largest producer, touched a high of 2,475 rupiah on Monday and Tuesday, the highest price since May 5.

"Timah's performance will be helped because of the improvement in tin price," said Wardhani. "Timah's share price may climb to 3,000 rupiah by year end."

Tin futures in London have gained 15 percent this year, while nickel, the second-best performer, has advanced 12 percent, according to Bloomberg data. The three-month copper contract has lost 3.8 percent.

Bloomberg News