Cars

Vehicle demand 'peaked in first quarter'

By Marvin Zhu (China Daily)

Updated: 2010-05-24 13:16

|

Large Medium Small |

Lending, currency and policy converge to lower consumer confidence

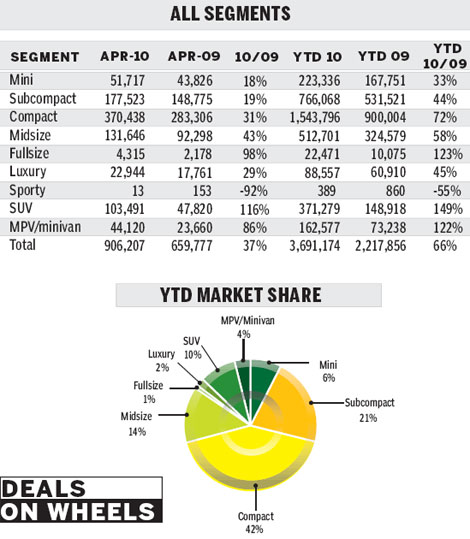

China's automotive market remains volatile. Speculation that strong sales in March were just building dealer inventories appears to be well founded. In April, light vehicle sales totaled 1.44 million units, 12 percent lower than the previous month, though still up 34 percent year on year.

Passenger vehicle sales rose 34 percent to 950,000 units. Small cars, ranging from minis to compacts, underperformed larger models, a result thought to be skewed by the inventory situation. Meanwhile, the midsize car, SUV and MPV segments maintained strong growth despite an increase in fuel prices.

|

||||

The segment was up 24 percent year on year as truck volumes still grew rapidly - benefiting from the numerous investment plans across the nation - but demand for minibuses slowed, increasing only 20 percent from a year ago.

The seasonal adjusted annualized rate in April was 15.5 million units a year, the third consecutive month of slowdown, supporting expectations that the market peaked in the first quarter and is likely to slow for the remainder of the year.

A series of government measures have tightened bank lending and the real estate sector. The stock market has fallen rapidly since the middle of April, while exports face increasing pressure from an appreciating yuan. The developments could compromise consumer confidence and vehicle sales are not likely to be spared.

Although the downside risks were foreseen, we expected the market to slow before April, and underestimated the impact from growing inventories. As a result we have raised our forecast by 500,000 units to 15.2 million units for 2010, a growth of 17 percent from the previous year.

Demand for passenger vehicles and light commercial vehicles this year is expected to reach 10.2 million units and 5 million units respectively.

Homegrown brands

At the Beijing Auto Show in April, more than 80 percent of new models making their world debuts were Chinese brands. Driving those ambitions is the rising homegrown share of the passenger vehicle market, up from 26 percent in 2005 to 30 percent in 2009, and 33 percent to date this year.

Benefiting from partnerships with leading global component suppliers, most of the equipment and technology used in international brands is now also fitted in locally branded models. Increasingly strong R&D has resulted in more Chinese manufacturers with their own powertrains competing directly with rivals in joint ventures.

Thanks in part to their price advantage and nationwide networks, small cars and minibuses from domestic brands have had remarkable sales growth in rural areas and secondary cities.

Yet in major cities where customers are more demanding, weak brand perception is still the biggest obstacle for Chinese players.

While the design of locally developed models is closing the gap with global companies, there is still wide disparity in vehicle quality and durability.

According to JD Power's customer satisfaction studies, surging output and rapidly expanding capacity are posing big challenges to homegrown carmaker quality control systems, which does not bode well for the higher-end models they want to roll out.

A fruitful 2009 has brought sufficient cash flow to many, and now talented people have become the most prominent demand for Chinese companies.

Brilliant decision-makers and experienced workers are critical for the company to ensure sustainable growth and stable quality. However, Chinese carmakers have trouble acquiring and retaining both, given the difference in working conditions between themselves and the joint ventures.

Through the next decade, domestic carmakers will not be able to rely solely on their low cost strategy, as Chinese consumers gradually transition from price-buyers to product-buyers. Only the companies with talented people enhancing service, marketing and product appeal will survive in the industry.

The author is a senior analyst at JD Power Consulting (Shanghai) Co Ltd.