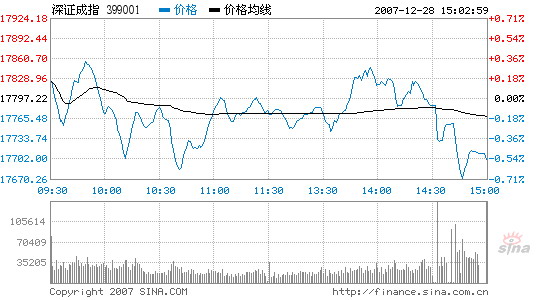

Market concludes the year with low-pitched finale

Updated: 2007-12-28 17:18

Shenzhen Component Index

Source: sina.com.cn

Gold miners also performed well. Shandong Gold Mining and Zhongjin Gold rose 7.88 percent and 5.63 percent respectively due to an overnight surge in international gold prices. The two stocks inked a feverish jump of more than 450 percent in 2007.

Looking back into the whole year's trading, although temporary dives and fluctuations occurred from time to time, investors are surprised to find the Shanghai Composite Index has almost doubled over the year. Along with the index rally, some stocks staged even more dazzling performances, never making the above gold miracles an isolated case.

China State Shipbuilding, one of the nation's largest ship makers, set a record 300-yuan price during the year starting from 30 yuan earlier this year. CITIC Securities, a well-known listed broker, also surged some 200 percent and wound up the year at 89.27 yuan. Behind these star companies and their marvelous share hikes are the booming Chinese economy and fast growing capital markets, providing the room for both their corporate profits and share prices to grow.

A recent survey by the Weekly on Stock Magazine showed that 90 percent of Chinese stock investors have profited from the year's stock market, although 70 percent of them failed to beat the major index's gaining margin. However, an overwhelming number of investors are confident about the market in the coming year. As many as 62 percent expect the Shanghai index to reach 8,000 points in 2008.

Although stock performances always go beyond public prediction, and market uncertainties may still fall in the coming year, it is reasonable to hope for a healthier capital market environment and a harmonious growth of China's economy in 2008, which act as the real foundation of a sustainable bull run.

|

|