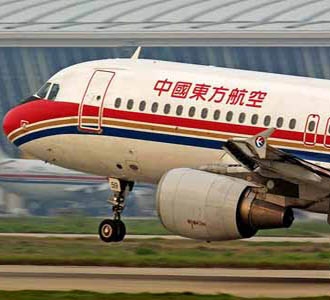

Eastern Air expects to return to profit

(Shanghai Daily)Updated: 2007-07-03 13:05 China Eastern Airlines expects to return to the black in the first half of this year, helped by strong business growth and recently introduced accounting rules, its chairman said yesterday.

For the full year, the carrier, which is awaiting

government approval to sell a stake to Singapore Airlines and its majority owner

in a nearly US$1 billion deal, is expected to book around 200 million yuan

(US$26 million) in net profit, reversing a net loss of 2.78 billion yuan in

2006, Li Fenghua said.

For the full year, the carrier, which is awaiting

government approval to sell a stake to Singapore Airlines and its majority owner

in a nearly US$1 billion deal, is expected to book around 200 million yuan

(US$26 million) in net profit, reversing a net loss of 2.78 billion yuan in

2006, Li Fenghua said.

"I think we will be profitable in the first half as our performance has been very good," Li said, adding that new Chinese accounting rules also helped to boost its bottom line.

China Eastern, one of the country's three largest airlines, had previously said it expected to report a loss for the first half of this year.

The carrier has reached an agreement to sell a nearly 25 percent stake to Singapore Airlines and Temasek, which Li said was still awaiting government approval.

Industry sources said that China Eastern would also issue shares to its State-run parent, which held 61.64 percent of the carrier as of the end of 2006, to ensure that it retains control after the stake sale.

The partnership could give China Eastern access to Singapore Air's extensive global network and its financial backing.

Analysts said it could also enable China Eastern to better compete with domestic rival Air China, which has forged an alliance with Cathay Pacific Airways in a share-swap deal.

It would also leave China Southern Airlines, which operates the country's largest commercial fleet, as the last of China's top three airlines without a foreign strategic equity partner.

(For more biz stories, please visit Industry Updates)