Retailing not a cinch in market

By Hubert Hsu, Vincent Lui, Jeff Walters and Joseph Wan (China Daily)Updated: 2007-04-25 08:45

Retailers are tripping over one another to gain a foothold

in China.

Retailers are tripping over one another to gain a foothold

in China.

Wal-Mart's acquisition of Taiwanese-owned Trust-Mart and Tesco's decision to increase its stake in its Chinese joint venture are examples of competition heating up. Best Buy, The Home Depot, Walgreens and many luxury-goods retailers are pouring in as well.

Domestic retailers such as Gome in electronics and Wumart in groceries have also been rapidly expanding their store coverage.

But as exciting as the prospect of 1.3 billion consumers is, setting up stores in this vast and varied country is no cakewalk. Getting products to the consumers who want them at the right price is still a formidable undertaking. Understanding China's unique challenges is a first step toward developing a winning strategy.

First, it isn't inevitable that modern retail concepts tested and tried in Western countries will win out. Some traditional stores typically malls or marketplaces that house many mom-and-pop stores are putting up a strong fight.

In electrical appliances, for instance, 35 percent of sales still come from independent and neighborhood stores. In home decoration, a whopping 83 percent come through the traditional channel. For personal computers, it's 70 percent, and for mobile phones, 55 percent.

Traditional sales channels can often trump modern retailers in assortment and pricing. Long-time customers believe they offer more variety and lower prices.

Diverse customers

Furthermore, there is no typical Chinese consumer. Such diversity often calls for customized products and services, as well as a different product mix from one city to another.

We found an 80-percent difference in the number of SKUs (stock keeping unit) for bar soap carried by two stores owned by the same chain one in Beijing and one in Shanghai.

The key to profitability is to find the right balance between uniformity and customization. Too much uniformity will reduce attractiveness to shoppers, whereas too much customization will hurt economies of scale and lead to lower margins.

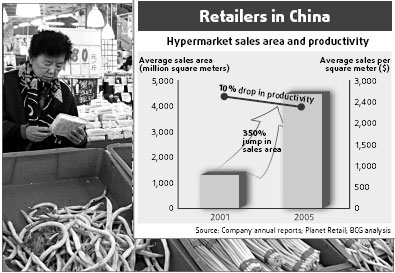

Another challenge is balancing growth and sales productivity per square

meter. Many retailers have announced aggressive expansion plans. Most of these

companies are enlarging their footprint rather than increasing productivity.

They hope their profit margins will catch up once they have more stores.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)