Asset injections boost share prices of SOEs

By Zhang Ran (China Daily)Updated: 2007-02-15 09:21

Despite recent debate on whether a developing A-share bubble had led to a short-lived market slowdown, the main index is once again showing signs of livening up, right before Spring Festival.

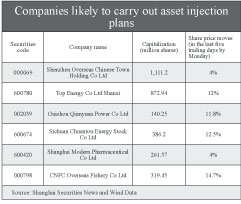

Asset injections are seen as the main trigger of investor enthusiasm and will lead market growth in the coming months.

Specific to the mainland, "asset injection" refers to the placement of high-quality assets from State-owned enterprises (SOEs) into their listed subsidiaries. Industry insiders also call this practice "SOEs listing in their entirety".

Shares in some listed SOEs have seen impressive growth since they publicly announced asset injections or were believed to have carried out such activities.

Listed SOE Hudong Heavy Machinery Co Ltd said on January 29 it would issue

400 million shares to buy a package of high quality assets from its parent

company China State Shipbuilding Corporation. By Monday, the Shanghai-based

company's share price had jumped 97 percent.

On February 5, another listed SOE, Dongfang Electrical Machinery Co Ltd, said it would purchase a 68.05 percent share in Dongfang Boiler (Group) Co Ltd from its parent Dongfang Electric Corporation by issuing 367 million A shares. The move pushed its share price up 43 percent by Monday.

Asset injection activities are not limited to central government SOEs. Local listed SOEs such as Shenzhen Airport Co Ltd and Guangxi Guiguan Electric Power Co Ltd that carried out asset injection plans rose 19 percent and 16 percent respectively in February.

Investor confidence in these companies is based on an expectation that China's continual efforts to restructure its SOEs, especially those directly owned by the central government, will help improve their competitiveness.

The expectation was especially inspired by a government guideline released in

December by the State-owned Assets Supervision and Administration Commission

(SASAC). The guideline urged high quality SOEs to either go public directly or

inject their high quality units into their existing listed companies after

restructuring.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)

| ||