Starting it all in HK

Hong Kong's unique economic advantages and ecosystem have made it a premier destination for international startups, which see the city as indispensable for growth in the Asia-Pacific region. Jessica Chen reports from Hong Kong.

An ideal springboard

Although Hong Kong's small and medium-sized enterprises managed to ride out global financial crises in the past, they are now struggling like never before amid sluggish economic growth, posing challenges for their agility and vitality.

However, Casinelli remains uncompromising. "A good market is still a good market," he says. He is certain that Hong Kong is the perfect strategic place for his fintech startup to win markets across Asia. "Hong Kong is an integral part of our growth strategy for the Asia-Pacific region as it's our first venture outside of Southeast Asia."

The global geopolitical problems are real, but the state of the market is what really matters to ambitious firms like Aspire.

According to Hong Kong's Trade and Industry Department, there were 360,000 SMEs in the city as of March, employing 1.2 million people. Most of the SMEs were engaged in the import-export and wholesale industries, with professional and business services coming second.

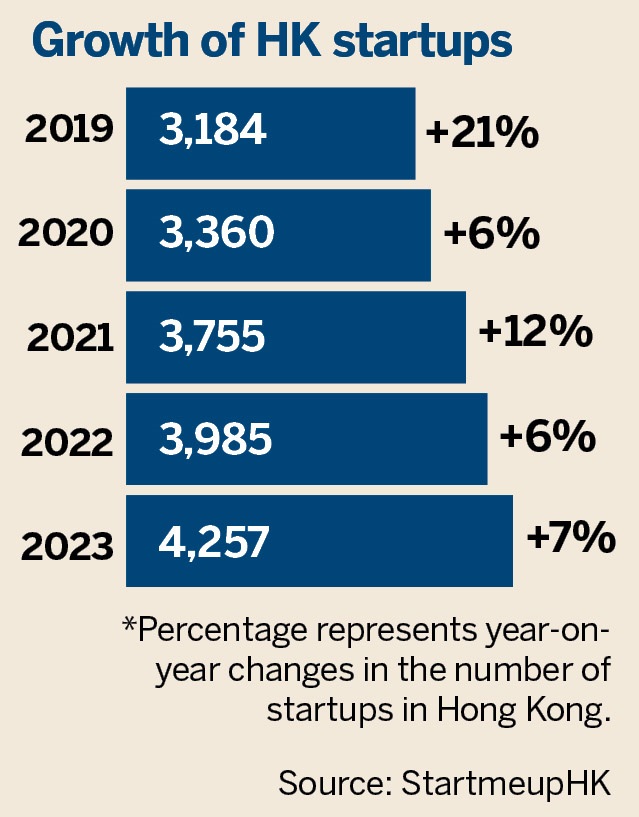

A 2023 DBS survey showed that Hong Kong is witnessing a revival of business digitalization, with 93 percent of SMEs recognizing the digital trend as critical for their growth. At the same time, Hong Kong is experiencing an entrepreneurial boom, with the number of startups having more than tripled in the past decade.

"Hong Kong stands as a thriving ecosystem for startups and fintech worldwide, offering a conducive environment for growth and innovation," says Leung Hong-king, global head of financial services, fintech and sustainability at InvestHK — an HKSAR government agency geared to supporting investment and business expansion.

Hong Kong's market-driven startup ecology is appreciated by entrepreneurs who have ventured into the city of opportunity. Harry Chen, a Canadian entrepreneur, says he finds Hong Kong to be the "best choice" in tapping into the wider prenatal and neonatal healthcare market in the Guangdong-Hong Kong-Macao Greater Bay Area.

Chen, a graduate of the University of California, Berkeley, sees the HKSAR's deepening integration into the GBA as too promising for a bio-health startup to underestimate. "Hong Kong is a strategic location because of its access to a large population, and it's just one step away from manufacturers in the Pearl River Delta," says Chen, who is a partner and chief financial officer of E3A Healthcare — a biotech startup founded in Singapore in 2019.

The firm started from scratch, initiated by a team of researchers from the National University of Singapore, and set up a holding company in Hong Kong the same year despite the social unrest in the city. For E3A Healthcare, getting a foothold in Hong Kong to access the market in the populous GBA is strategically vital, and its confidence in Hong Kong remains strong.

"Singapore's market is relatively limited," says Chen. The HKSAR's strategic status in China and Southeast Asia is more important because of its ready-made market access to densely populated regions, he adds.

E3A Healthcare raised its first venture capital in Hong Kong through financial advisors, following a common pattern of how international players find their way to Hong Kong. The city's universities and Hong Kong Science Park, as well as San Tin Technopole, which unites the sister cities of Hong Kong and Shenzhen, are all on the startup ecosystem. StartmeupHK — an agent operating under InvestHK — also holds conventions, salons and forums to support the startup community.

The City University of Hong Kong's HK Tech 300, for example, provides training and growth opportunities for young entrepreneurs and translates the university's research and intellectual property into practical applications. Having won an award in the HK Tech 300 Southeast Asia Startup Competition in June, E3A Healthcare planned to make a further foray into Hong Kong. The biomedical player has now mapped out a clear path to an initial public offering in the city or on Nasdaq within the next three years.

"Given the existing infrastructure and the dynamic path of chapters 18A and 18C at Hong Kong Exchanges and Clearing, E3A Healthcare would find it comparatively easier to go through the whole process," says Chen.

A survey conducted by InvestHK in 2023 showed that the number of startups in the city had surged over 30 percent since 2019. Despite external and internal challenges, their number has continued to grow, reaching a record high of 4,257 last year. Among the startups, about 26 percent of their founders were nonlocals, mostly from the Chinese mainland, the United Kingdom and the United States. The statistics show that Hong Kong is an international arena for entrepreneurs from across the globe.

- Xi, King Tupou VI attend signing ceremony of cooperation documents

- China to launch Shenzhou XXII at 12:11 pm

- Xi meets Tonga's king

- Xi holds welcome ceremony for Tonga's king

- Chasing secrets of the universe on world's rooftop in SW China

- Xi sends congratulatory message to 7th China-Russia Energy Business Forum