Turning the economy around

Creating growth engines

Mak praises the government's recent measures to attract capital and talents as "positive" in alleviating the negative impact on revenues due to the recent exodus of capital and talent from Hong Kong. He is confident that Hong Kong's credit rating can be maintained despite growing budget deficits.

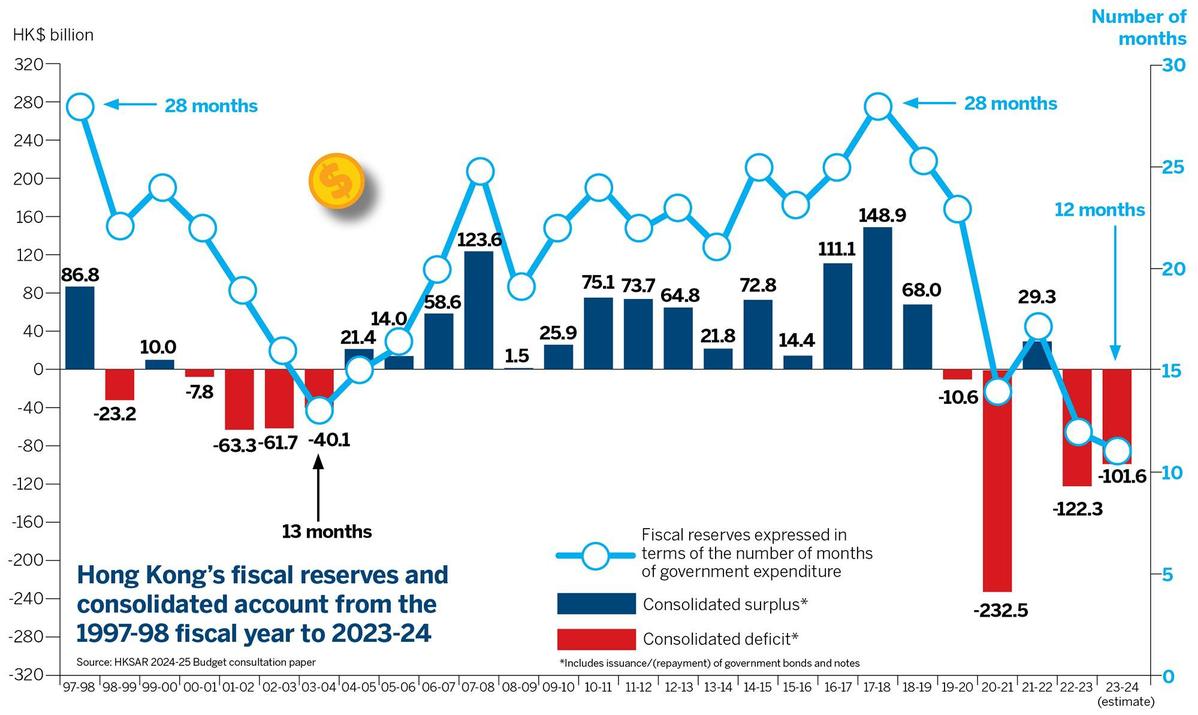

"I do not think Hong Kong's current public finance situation is in such a poor state that bonds have to be issued to meet recurrent expenses. Even if the government resorts to issuing bonds for infrastructure and land projects, it still has the financial arsenal to repay its debts, as its outstanding bond issuance amount is relatively small, compared to its ample fiscal reserves. But the administration has to be careful if the city's fiscal reserves continue to drop," he warns.

The SAR says it will implement a comprehensive fiscal consolidation program to contain operating expenditure growth and increase revenue, but US-based credit rating agency Fitch Ratings said it expects this approach to be unlikely to succeed in restoring a balanced budget in the coming years. Fitch said it expects the government budget deficit (excluding bond issuance proceeds) to narrow to about 3.2 percent of GDP in the 2024-25 fiscal year, reflecting the reduction in countercyclical measures, and the limited recovery of revenue sources, such as land premiums and stamp duties.

ASEAN+3 Macroeconomic Research Office says increasing fiscal reserves and rebuilding fiscal policy space in line with the ongoing economic recovery should be the priority for the SAR government.

The research center advises the administration to consider implementing comprehensive tax reforms to broaden its revenue base, for example, exploring the feasibility of introducing new taxes, such as value-added taxes and capital gains taxes in the medium to long term. The government can also explore the possibility of enhancing a progressive personal income tax regime as part of overall tax reform, it says.

Other business chambers and professional auditing firms however oppose the idea of levying new taxes or raising profits and salaries taxes to rein in the spiraling budget deficit, as the local economy continues to face significant challenges amid the global economic malaise, high interest rates and geopolitical uncertainties.

"As the SAR government is facing immense financial pressure, it should adopt a multipronged approach to ensure economic stability, and be prudent with public finances, while providing targeted financial relief to enterprises and taxpayers," says Agnes Chan Sui-kuen, deputy chairman of the Hong Kong General Chamber of Commerce - the city's oldest business organization representing multinational companies.

"We do not recommend levying new taxes, such as a sales tax or capital gains tax, because it is important for Hong Kong to maintain a low and simple tax regime," says Deloitte China Tax Partner Polly Wan Pui-yee. "The administration would have to incur administrative costs by levying new taxes. Businesses would also have to shoulder huge administrative costs to meet the compliance demand if a capital gains, or a sales tax is levied."

Economic experts generally agree that the fundamental way to deal with fiscal deficits is to revitalize the economy by encouraging corporate investment and lifting Hong Kong's economic momentum and competitiveness.

Deloitte Tax Partner Doris Chik Wai-chi recommends that efforts be taken to promote Hong Kong as a regional business hub; encourage initial public offerings by lowering IPO costs, capped at HK$5 million; propel innovation and technology development; and refine the tax system relating to intellectual property.

"The government should devote its financial resources to three areas - creating more economic growth engines, promoting economic transformation through digitalization, and helping Hong Kong enterprises to find more markets," says Anthony Lau Ming-yeung, co-chairperson of CPA Australia's Greater China taxation committee.

Besides raising economic competitiveness, the HKGCC would like the government to conduct a thorough review of whether any new broad-based taxes could be introduced to rein in the soaring budget deficit.

Karina Wong Man-fai, CPA Australia's Greater China divisional deputy president and taxation committee deputy chairperson, proposes a comprehensive review of the tax system to explore every possible revenue source.

"Such a review should be based on Hong Kong's overall economic development trend and goals, as well as the local social patterns," she says.