Washington's 'chip war' doomed to failure

Of all the bids issued by Chinese silicon wafer factories on mechanical devices from January to August, 47.25 percent went to domestic manufacturers, says an analysis by Huatai Securities. A report by domestic panel display consultancy firm CINNO Research further shows that the top 10 domestic silicon wafer device manufacturers had seen their device-related revenue increase by 39 percent in the first half of 2023 to reach $2.2 billion.

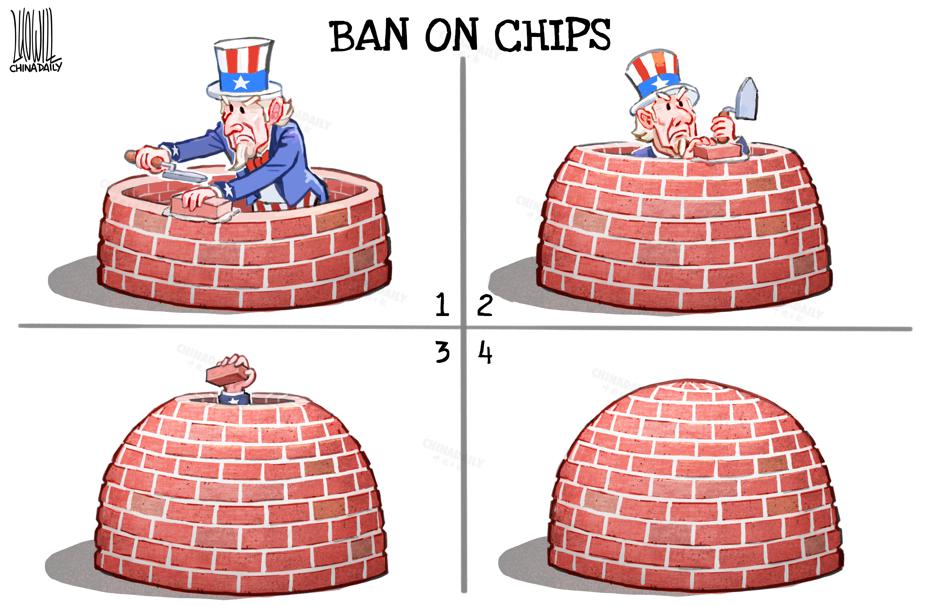

Even the Western media have noticed that Chinese manufacturers are strengthening their grasp on chip technology as the United States tightens its export control on chips and related technologies. Ever since the US government first introduced its chip export ban against Chinese companies, the rules are being tightened further, with the US even pressuring its allies to follow suit.

In this backdrop, the only choice before Chinese companies is to develop their own technologies. That's also what Chinese companies have been doing, as shown by recent reports. They are sharpening their tools and that is giving them a major share of the domestic market.

The Chinese semiconductor industry now ranks sixth in the world with a 4 percent share of the global market. It is small compared with the leading players such as the US, but the gap is mainly because China lacks technologies such as those that are needed to produce 3-nanometer chips. But then such high-end chips are mainly used in smartphones where size is a factor, while laptops, lights and automobiles can do with bigger chips, an area in which Chinese companies enjoy an advantage.

Huawei's Mate 60 Pro model smartphone is believed to run on a 7-nanometer chip, which indicates possible breakthroughs by domestic companies. All these hint at possible acceleration in the evolution of domestic chip technology and prosperity for China's semiconductor industry.