Global art sales shift online, NFT prices soar

Magnet for collectors

The city is steeped in the trading of Chinese antiques and fine art, from the last century. Its Chinese antiques trading reputation has made it a magnet for international collectors and dealers. Local auction sales "see a balance of Eastern and Western art collectors", says Francis Belin, Christie's Asia-Pacific president.

Christie's confidence in the Hong Kong art market prompted it to hold public education programs and landmark shows in Hong Kong during the pandemic, which brought a host of collectors, said Belin. The Basquiat Show held in May afforded the public a rare exposure to the late graffiti pioneer artist Jean-Michel Basquiat's oeuvre.

Hong Kong is the "Southern Gate" to the entire Chinese market and the only city in China that operates under a common law legal system familiar to most international investors. It is the perfect catalyst and value-adding facilitator between buyers and sellers at home and abroad, says Nicholas Chan, co-founder of Refinable, the first major decentralized, multi-chain NFT marketplace.

Stakeholder trust

There is considerable trust in the city's well-established contractual, private property, and copyright laws. All the stakeholders in art sales secure trust and transparency in transactions, notes Chan. "We have strong data privacy laws, Global 100 law firms operate in Hong Kong, and top lawyers reside here."

Hong Kong boasts a healthy art milieu, buttressed by blue-chip global galleries, sophisticated wealthy collectors, and seminal global art fairs, such as Art Basel, says art advisor Jehan Chu. Cultural institutions like the M+ Museum, Hong Kong Art Museum, Asia Art Archive, and Parasite Art Space, nurture its art environment. "Hong Kong has all the supporting legs of the stool," says Chu.

"Its strategic location makes it easily accessible for clients from the APAC region and beyond; and the city's proximity to Chinese mainland increases its accessibility to the expanding Chinese economy and rising number of collectors," observes Nathan Drahi, managing director of Sotheby's Asia.

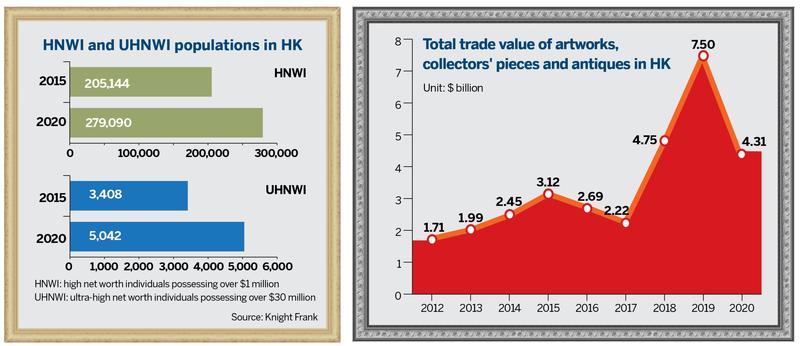

Jonathan Crockett, Asia chairman of Phillips, says that as traditional investment in financial markets is highly uncertain, ultra-high net worth individuals, or UHNWI, with over $30 million in assets, are diversifying their portfolios. The appreciation potential of art appeals to them. There were 5,042 UHNWI in the city in 2020, a 13 percent increase over 2019, according to real-estate consultancy Knight Frank's 2021 report.

- Research ward at children's hospital in Shanghai treats over 200 patients with rare diseases

- Chongqing symposium examines planning cities around sound, smell, touch

- Former Qingdao legislature chief under investigation

- Former Xinjiang prosecutor Guo Lianshan under investigation

- Shandong and SCO discuss trade, investment and supply chain cooperation

- China courts see surge in maritime cases, foreign disputes