Improving macro-prudential policies for economic stability

The People's Bank of China, the central bank, recently issued a guideline on macro-prudential policies for trial implementation.

The guideline defines some concepts related to macro-prudential policies, expounds the main contents of the macro-prudential policy framework, and puts forward support guarantees and policy coordination requirements for the implementation of macro-prudential policies to improve the country's ability to defuse systemic financial risks.

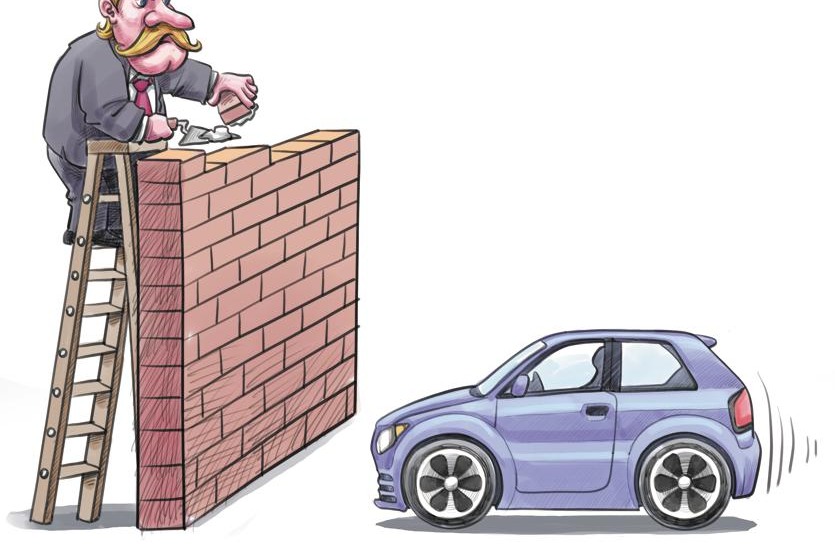

The idea is to prevent systemic financial risks through macro, counter-cyclical and preventative means, thus improving the resilience of the financial system, reducing the possibility of a financial crisis, and promoting the overall health and stability of the financial system.

Strengthening macro-prudential policies has become key to preventing systemic financial risks, since the 2018 international financial crisis.

In recent years, the Financial Stability Board, the Bank for International Settlements, other major international organizations have issued a series of standards on the establishment and improvement of macro-prudential policy frameworks.

China suggested the construction of a macro-prudential policy framework in both the 12th Five-Year Plan (2011-15) and 13th Five-Year Plan (2016-20). At its fifth national financial work conference in 2017, China explicitly called for the establishment of a macro-prudential management framework. The 19th National Congress of the Communist Party of China also emphasized the need to improve the dual-pillar regulatory framework of monetary policy and macro-prudential policy.

China's central bank began studying policies and measures to strengthen macro-prudential management in 2009, and formally introduced the differential reserves dynamic adjustment mechanism in 2011.

In 2015, the central bank brought foreign exchange liquidity and cross-border capital flows under macro-prudential management to facilitate cross-border financing and guard against cross-border capital flow risks. In 2016, the differential reserves dynamic adjustment mechanism was officially upgraded to macro prudential assessment, and since then, China has incorporated off-balance sheet financing, inter-bank certificates of deposit, green finance and inclusive small and micro loans into MPA, and gradually explored the establishment of a regulatory framework for financial holding companies and systemically important banks.

Financial innovation will increase the fragility of the financial system. It is thus necessary to further improve policy tools and bring a wider range of financial assets, financial institutions and financial markets under macro-prudential management. These policies should cooperate well with monetary, fiscal, industrial and credit policies and micro-prudential supervision. From the perspective of the two-pillar regulation framework, the country should link macro-prudential policies with monetary policies to achieve price and financial stability.