Who suffers most from US sanctions?

On Friday, the US Department of Treasury announced the so-called "Hong Kong Business Advisory" that highlighted "growing risks" in the Hong Kong Special Administrative Region, while seven officials from the Liaison Office of the Central People's Government in HKSAR were added to the sanction list.

It is rather ridiculous to describe businesses in Hong Kong as facing "risks". In the first half year of 2021, Hong Kong stock market saw 47 initial public offerings (IPOs), with the total amount of financing funds reaching HK$212.9 billion (US$27.4 billion), third to that of Nasdaq and New York Stock Exchange only.

According to the UNCTAD World Investment Report 2021, global FDI inflows to Hong Kong rose to US$119.2 billion in 2020, ranking third globally; Hong Kong's export is also expected to recover by 5 percent in 2021.

Money does not lie; It flows to where there is security, stability, and prosperity. So how could anybody label this "risks"?

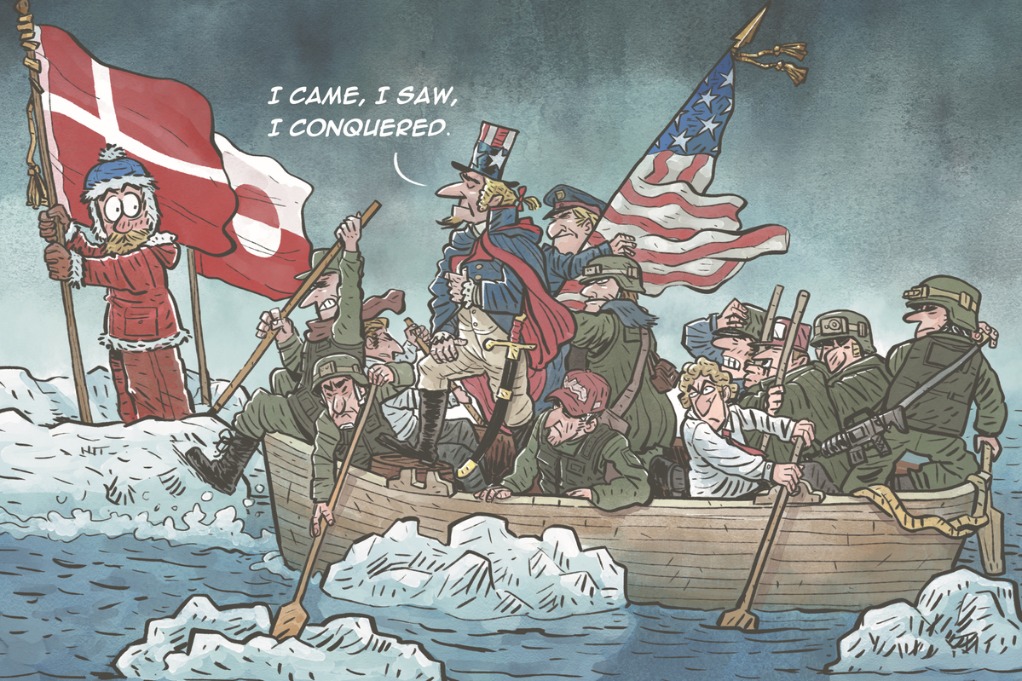

Even more ridiculous is the fact that such words come from a US official document. The US is the biggest risk facing Hong Kong business environment if there is any; If it continues holding a hostile approach toward China there might be risks about it adopting higher tariff rate to goods from Hong Kong.

But that would hurt US consumers more because, to quote a popular US poster in 2018, tariff is tax. That would mean US consumers have to pay a higher price for the goods and services imported from Hong Kong, or China as a whole. Definitely not good news for US consumers who buy, US enterprises that trade, and US economy that's struggling.

And don't forget that China now has the anti-sanction law and all sanction measures will get their deserved fight-backs.

In December 2020, Bloomberg reported that Donald Trump, then-US president, issued three sanctions a day on average since 2017, with the total number exceeding 3,900 one month before the end of his term. With foresight, it said that the Joe Biden team "signaled it sees value in that tool" and was likely to keep it.

Sadly that foretelling seems to be coming true.

Unfortunately US economy, US enterprises, and US consumers continue to suffer.