Opportunity knocks

New infrastructure offers fresh development opportunities for traditional businesses

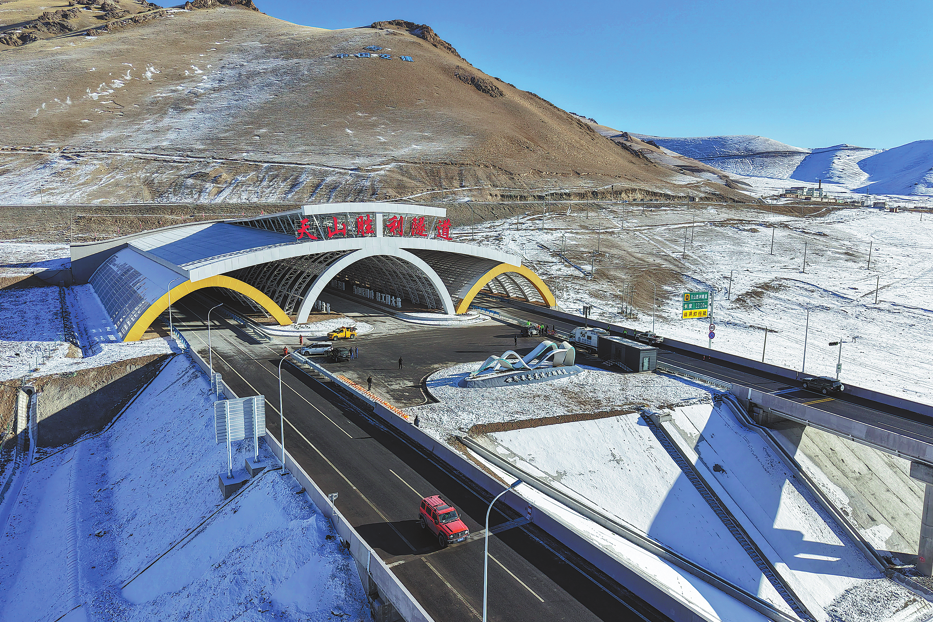

China's infrastructure construction has witnessed rapid growth since the start of reform and opening-up in the late 1970s. However, infrastructure facilities, such as roads, bridges, ports and pipelines, belong to the category of traditional infrastructure. China's policymakers have been mulling support for "new infrastructure" in recent meetings.

According to the National Development and Reform Commission, new infrastructure projects can be divided into three categories. The first is information-based infrastructure, which mainly refers to infrastructure for new-generation information technology such as 5G and the internet of things, and computing power infrastructure represented by data centers and intelligent computing centers. The second is converged infrastructure, which mainly refers to the in-depth application of the internet, big data, artificial intelligence and other technologies that support the transformation and upgrading of traditional infrastructure, such as intelligent transportation, smart grids and smart cities. The third is innovation infrastructure, which mainly refers to public-welfare infrastructure that supports scientific research, technology development and product development, such as major scientific and technological infrastructure, science and education infrastructure and industrial technology innovation infrastructure.

"China's Urbanization 2.0: New Infrastructure Opportunities", a research report released by Morgan Stanley early this year, says that there are three initiatives to bypass hurdles to China's further urbanization-forming super city clusters, building smart cities and modernizing the agriculture sector. As a result, the average annual investment for new infrastructure, represented by intercity high-speed railways and rail transit, artificial intelligence and data centers, 5G base station infrastructure, the industrial internet of things, ultra high voltage power grids and electric vehicle charging stations, could reach $177 billion in 2020-30, almost twice the past three year's annual average ($100 billion in 2017-19). Meanwhile, Morgan Stanley expects the average share of private investment for intercity high-speed railways and rail transit and the industrial IoT to double from 25 percent to 50 percent and from 30 percent to 60 percent, respectively, while private investment for electric vehicle charging and AI and data centers could remain around 75 percent and 44 percent, respectively. Although Morgan Stanley's definition of "new infrastructure" varies from that of the NDRC, we can still see the bright development prospects of new infrastructure from this report.

How can traditional businesses tap into this new trend? Take petrochemical companies as an example, the following actions could be taken.

First, they should speed up the digital transformation of their production and distribution networks. With the clear understanding that a company's capability in digital transformation is an integral part of its competitiveness, petrochemical companies should, on the basis of the already widely introduced office software and internet-based management system, actively promote the construction of smart factories and smart logistics and create sample projects for the industry to improve economic performance and competitiveness. Based on this, they could further develop new business models, business growth points and sources of revenue, such as combining "internet plus" practices with their traditional businesses to become a solution provider for manufacturing intelligence, safe transportation and safe production in the petrochemical industry.

Second, they should prudently promote business diversification and steadily participate in businesses related to new infrastructure and emerging industries. The petrochemical industry is a typical capital-intensive one, featuring scale production, standard operating procedures and standardized products and therefore has a "mechanical efficiency-centric" corporate culture and management model. While for new infrastructure and emerging industries, which are typical knowledge-intensive industries, professional skills are the most important production factor for a company, therefore creating a "people oriented" corporate culture and management concept is important. When diversifying their businesses, petrochemical companies should properly handle the potential conflicts in corporate cultures and management concepts between different companies and different industries, otherwise their business diversification strategy could fail. The companies should carefully evaluate their own strategic resources and capabilities, such as their sales network, customer base, brand attractiveness and human resources. After gaining a full understanding of their own resources and strengths, they should carry out in-depth investigation of the features and requirements of new business fields, strategic resources and core capabilities of potential partners and the requirements for business and cultural integration following possible strategic cooperation. Specifically, given the massive sales network of the petrochemical system, petrochemical companies could take smart logistics and smart retail as one development direction.

Another good idea is to carry out strategic cooperation with grid companies, such as the State Grid, to develop the smart charging system. There are, however, lots of prerequisites to the success of such strategic cooperation, such as the technical standard of charging stations, support equipment from the grid system and the popularization of electric vehicles.

Finally, petrochemical companies could further expand their investment scope to tap into the growth opportunities of new infrastructure and emerging industries. Companies in a mature industry normally have an adequate cash flow. Petrochemical companies could establish investment funds to directly or indirectly participate in new infrastructure projects. There are three possible ways. The first is to participate in new infrastructure projects via public-private partnerships (PPPs)-joining hands with business partners or doing that alone. The second is to participate in private projects in emerging industries via equity investment on the basis of careful targets selecting. The third way is to actively participate in asset-backed-securitization transactions to get stable investment returns from traditional infrastructure projects, which will also see rapid growth amid government incentives for new infrastructure development.

Traditional businesses should seize the investment opportunities deriving from the exponential growth of new infrastructure.

The author is a researcher of the Department of Macroeconomic Research at the Development Research Center of the State Council. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.