Switch to swing the balance

China is shifting to a domestically focused development pattern to realize the potential of its new comparative advantages

The dual circulation development pattern is not a retreat from the global economy but rather updated and upgraded opening-up. To rebalance the development pattern toward the domestic market leverages new China's comparative advantages.

The comparative advantage theory suggests that by exporting abundant factor-intensive commodities and importing scarce factor-intensive commodities, all countries can benefit from international trade. China has for many years enjoyed a competitive advantage in labor-intensive manufacturing.

But China is losing its comparative labor advantage. First, as labor costs of manufacturing increase, the share of value added of manufacturing in China's gross domestic product declined from 32.5 percent in 2006 to 27.2 percent in 2019.Second, as the complementarities of comparative advantages between China and the developed countries weakens, China's merchandise exports to high-income economies as a percentage of total merchandise exports declined from 81.4 percent in 2006 to 69.6 percent in 2018. Third, as a result, China's merchandise trade as percent of GDP decreased from 64 percent in 2006 to 31.9 percent in 2019.

China's involvement in the global division of labor and the development of the domestic economy are closely linked. Talking about international or domestic circulation, therefore, always means talking about dual circulation combining both. As the factors influencing these circulations change, the balance point between domestic and international circulation alters as well. This requires a necessary adjustment of strategy and transformation of the development pattern.

That China is losing its comparative advantage of cheap labor is reflected in the upgrading of its industry and the increasing intensity of capital and technology in its exported goods. The rebalanced development pattern is based upon the country's new comparative advantages.

The new technological revolution characterized by the ascendant artificial intelligence and the internet is transforming manufacturing from a single producer's tasks to an interdependent process of multiple producers. As the Nobel laureate in Economics Michael Spence put it, no country has a comparative advantage in making iPhones. What they do have is comparative advantage in generating elements of the iPhone global value chain (GVC) in key services, components and assembly.

China's position as the world's largest producer and exporter of manufacturing actually manifests in its significant role in the GVCs. China may be losing its comparative advantage in labor-intensive goods, but it holds comparative advantages in many production processes and technology links in the global value chains, which allows Chinese manufacturers to remain firmly embedded in the GVCs.

The experiences of East Asian economies show that as one economy loses its comparative advantage in labor-intensive industries, those industries transfer to other economies endowed with a cheaper labor force. The pattern of such industrial transfers, successively from Japan to the "four tigers", to some Southeastern countries, and to coastal China, has been called the "flying geese" model.

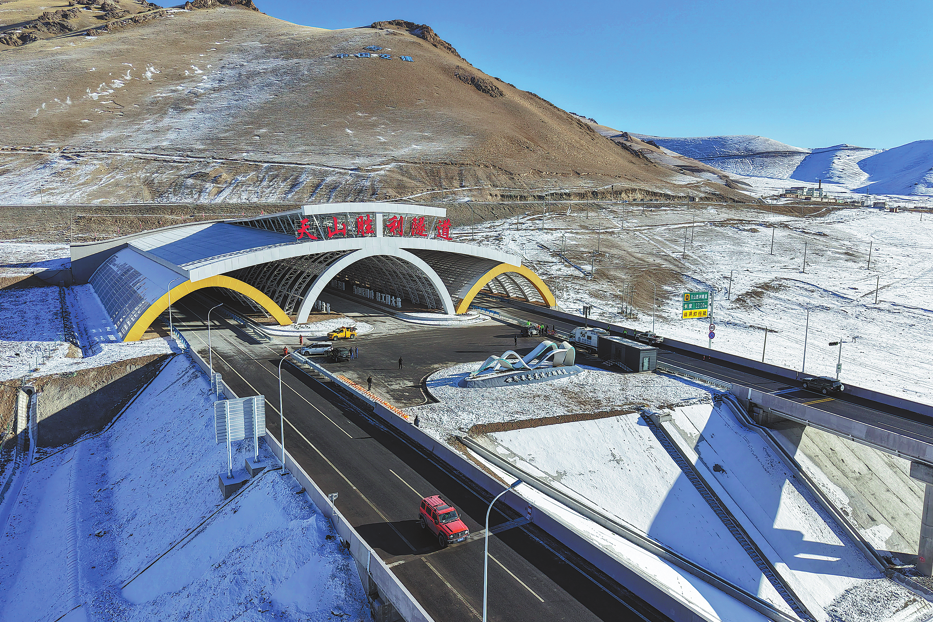

Given the wide differences in resources endowments and development levels among the eastern, central and western provinces, China's traditional industries have large room to transfer among domestic regions before they transfer overseas. That is a unique version of the flying geese model. The industrial transfer and its induced infrastructure construction in central and western regions can significantly raise the demand for investment, which the strengthening of weak links and exploration of new growth areas can meet.

International trade and foreign direct investment rely on the low production cost brought by the comparative advantage of resources. In reality, the number of consumers and sales are always an important consideration in the decision-making of investors and trading partners.

As China has the world's largest population and largest and growing middle-income group in the world, the demand side consideration is bound to have an extra weight in the making of trading and investment decisions. Even in the wake of the novel coronavirus pandemic, when potential partners weigh the balance between security (decoupling) and profitability (not decoupling), China's huge market can significantly tilt the decision toward the latter. The more China gives full play to the potential of its market, the more it can enhance its position in the GVCs.

The proposed dual circulation pattern is synonymous with high-quality development, which should be implemented by extending the comparative advantages of China's industry, matching the supply-and demand-side driving forces of China's growth, and balancing internal and external demands of the economy. Here are some policy suggestions.

In the short term, China should make full use of the opportunity of taking the lead in recovering from the pandemic to show its economy's resilience and contribute to the resumption of the world economy. In the long run, China will have to combine its innovative development with the comparative advantage of its market to strengthen its position in the GVCs.

To attract investment, central and local governments should make more efforts to improve the business environment by creating level playing fields for all enterprises, incentivizing innovation and protecting intellectual property rights, so that the potential of investment can be realized. To increase the demand for investment, infrastructure should be improved to adapt to and accommodate new technologies.

Also consumption should be stimulated. In 2019, China's share of the world's GDP was 16.3 percent, whereas its share of the world's final consumption was only 12.1 percent, which indicates there is much room for the consumption of Chinese residents to catch up. Raising people's incomes and reducing income inequality will significantly stimulate consumption given that middle-income residents have a higher propensity to consume. Implementing more wealth redistribution to provide more equalized public services would reduce unnecessary savings.

China's comparative advantage has dynamically changed as its economy has developed and its comparative advantage is no longer an abundance of cheap labor but its huge market and position in the GVCs as a result.

The author is the vice-president of the Chinese Academy of Social Sciences and the president of the China-Africa Institute at the CASS. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.