Trump avoided taxes 'for years'

WASHINGTON-US President Donald Trump assailed a New York Times investigation that alleged he had paid no income taxes for years.

"It's totally fake news," Trump said at a White House news conference on Sunday, again insisting that his tax returns are "under audit" by the Internal Revenue Service, or IRS.

"When they're not, I'd be proud to show you. ... I paid a lot, and I paid a lot of state income taxes too," he claimed. "It'll all be revealed. It's all going to come out."

In fact, the president has filed several court challenges against those seeking access to his returns, including the US House of Representatives, which is suing to get Trump's tax returns as part of congressional oversight.

The New York Times article said Trump's tax bill was only $750 in 2017, the year he took office. In 2016, he also reportedly paid only $750 in federal income taxes.

"He had paid no income taxes at all in 10 of the previous 15 years-largely because he reported losing much more money than he made," the article said.

The details of the tax filings complicate Trump's description of himself as a shrewd and patriotic businessman, revealing instead a series of financial losses and income from abroad that could come into conflict with his responsibilities as president.

The president's financial disclosures indicated he earned at least $434.9 million in 2018, but the tax filings reported a $47.4 million loss.

The filings also illustrate how a reputed billionaire could pay little to nothing in taxes, while someone in the US middle class could pay substantially more than him.

Roughly half of US citizens pay no income taxes, primarily because of how low their incomes are. But IRS figures indicate the average tax filer paid roughly $12,200 in 2017, about 16 times more than what the president paid.

Pivotal moment

The disclosure came at a pivotal moment ahead of the first presidential debate on Tuesday and weeks before a divisive election against Democrat Joe Biden on Nov 3.

Trump Organization lawyer Alan Garten called the story "riddled with gross inaccuracies".

"Over the past decade, President Trump has paid tens of millions of dollars in personal taxes to the federal government, including paying millions in personal taxes since announcing his candidacy in 2015," Garten said in a statement.

"While we tried to explain this to the Times, they refused to listen and rejected our repeated request that they show us any of the documentation they purport to be relying on to substantiate their claims," the lawyer said. "This is just part of the Times' ongoing smear campaign in the run up to the election."

The New York Times said it declined to provide Garten with the tax filings in order to protect its sources, but it said its sources had legal access to the tax records of Trump.

During his first two years as president, Trump received $73 million from foreign operations, which in addition to his golf properties in Scotland and Ireland included $3 million from the Philippines, $2.3 million from India and $1 million from Turkey, among other nations.

The president in 2017 paid $145,400 in taxes in India and $156,824 in the Philippines, The New York Times said, compared to just $750 in US income taxes.

A former business mogul, Trump has refused to release his tax returns, which are being sought by Democrats and New York state investigators, during his presidency, breaking a decades-old tradition maintained by his predecessors, both Republicans and Democrats.

During his first general election debate against Democrat Hillary Clinton in 2016, Clinton said that perhaps Trump wasn't releasing his tax returns because he had paid nothing in federal taxes.

Trump interrupted her to say: "That makes me smart."

Xinhua - Agencies

Today's Top News

- Xi's book on governance hailed for insights into 'China miracle'

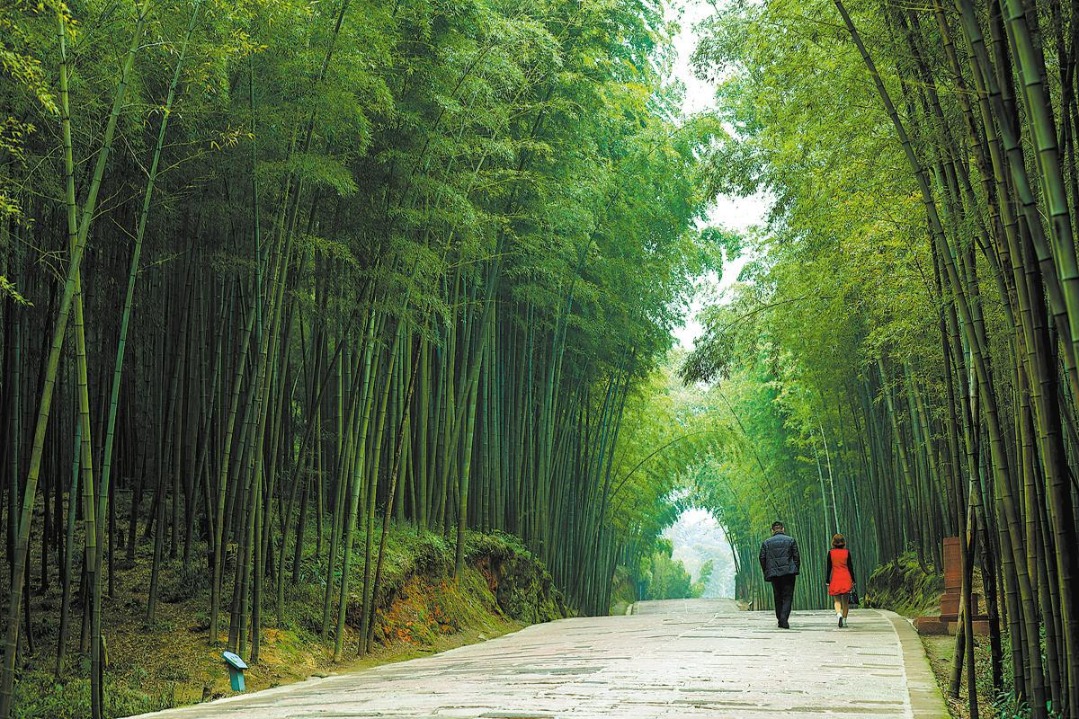

- European destinations swamped by tourists

- Economy expected to maintain steady pace

- Stable, healthy Sino-US ties benefit all

- CPC plenum to focus on next five-year plan

- Talks highlight the fact that cooperation benefits both sides, confrontation harms both