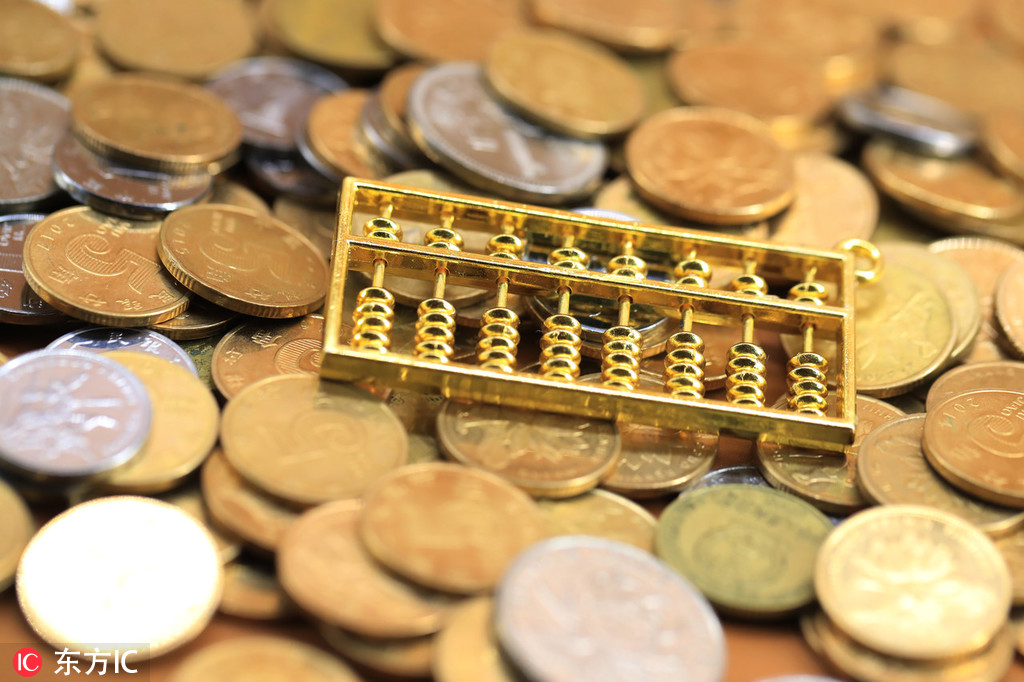

US law may affect investor confidence in HK

The United States' passing of the so-called "Hong Kong Human Rights and Democracy Act" would affect investor confidence in Hong Kong as an international financial center as well as its status as an independent tariff territory, economists warned.

David Wong Yau-kar, chairman of the Mandatory Provident Fund Schemes Authority, stressed investor confidence is important for an economy as open and international as the Hong Kong Special Administrative Region's.

The law might not have an actual impact on Hong Kong's economic activities, Wong noted. However, the US will review its favored trade status with Hong Kong on an annual basis and discuss the possibility of sanctions, he added.

Amid the trade war between China and the US, this would make investors worry whether there will be a limit to Hong Kong's imports from the US in high-tech products and other potential fields, Wong said.

With the addition of months of social unrest in the city, Wong said Hong Kong has been imposing more political risk on its investors than ever.

Because of doubts, Hong Kong's status in international wealth management can fluctuate while the city's long-time rival Singapore becomes a relatively safer destination, Wong warned.

The law does no good to Hong Kong, except in casting the SAR as a "pawn" between the US and China, Wong said.

His comments were echoed by Stephen Wong Yuen-shan, a board member at the Hong Kong Financial Services Development Council. Stephen Wong also noted Hong Kong is a highly export-oriented economy, which is very sensitive to uncertainties in the international situation.

The SAR needs a stable environment to maintain its status as a financial center, Stephen Wong said, stressing the US law can threaten Hong Kong's independent tariff treatment and lead to a possible decrease in the city's shipping and cargo transit volume.

- China-Laos international passenger line launched

- Beijing receives climate award at COP30 Local Leaders Forum

- Natl fire safety month promotes public safety awareness, risk prevention

- China reforms research review to boost young university staff

- Chinese researchers find freshwater snail species missing for nearly a century

- Top court strengthens legal protection for private firms