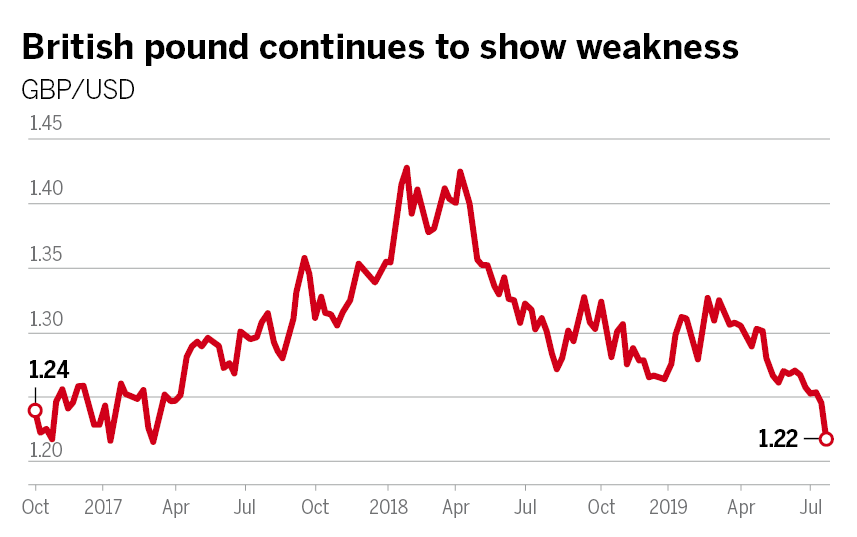

British pound falls to lowest in 28 months on Brexit doubts

The British pound fell to its lowest level in two and a half years on Monday as traders showed anxiety over the possibility of the United Kingdom crashing out of the European Union without a deal in three months' time.

The sterling sank to $1.223, a level not reached since mid-March 2017 when the UK triggered Article 50 and began the process of leaving the EU.

The currency could fall further, according to analysts at ING Group, as traders appear to have been betting on a last-minute deal being reached.

The currency swing means even fewer euros and dollars at the bureau de change for holidaymakers and rising consumer prices.

Sterling reached a two-year low versus the euro of below 1.10. There was also a fall against the Yen, and, as a trend, is it is down between 6 percent and 9 percent against the major currencies since the beginning of May.

Investors say a no-deal Brexit would tip Britain's economy into a recession, upset financial markets and weaken London's position as the pre-eminent international financial center.

Many business lobby groups have asked that no-deal be withdrawn as an option to keep investment flowing into the UK.

British Prime Minister Boris Johnson has said the Brexit divorce deal is dead and warned that unless the EU renegotiated, Britain would leave on Oct 31 without a deal.

Johnson is gambling that the threat of a no-deal Brexit will persuade the EU's biggest powers – Germany and France – to agree to revise the proposed withdrawal agreement that Theresa May failed three times to push through the British Parliament.

The pound dropped after "the events over the weekend, where the current stance of the new government became clear", said Petr Krpata, a currency strategist at ING Group.

Krpata says ING Group's assumption is that an early election will take place and that the pound will sink as low as 1.05 euros and $1.18.

Some of Johnson's most senior ministers did nothing to dispel investors' concerns, with Michael Gove, minister in charge of no-deal planning, saying that leaving without an agreement was now the government's working strategy.

Business groups lined up to voice frustration that a lack of information from the government was hampering preparations for no-deal.

The Federation of Small Businesses said the lack of preparedness among its members was "frightening", while the British Chambers of Commerce, or BCC, said industry's questions about how to prepare had "gone unanswered". The Institute of Directors said guidance from government had been partial and was yet to be properly road tested.

The BCC, which represents 75,000 businesses employing 6 million people, called on the government to up the ante on no-deal preparations.

"The Oct 31 deadline is fast approaching and businesses are being told to prepare for no-deal, but there are still significant areas where there is simply little basis on which to plan," said Claire Walker, co-executive director of the BCC.

"Business communities want the government to make every effort to avoid no-deal, but at the same time, urgently need it to up the ante on its planning to enable companies to prepare for all scenarios."