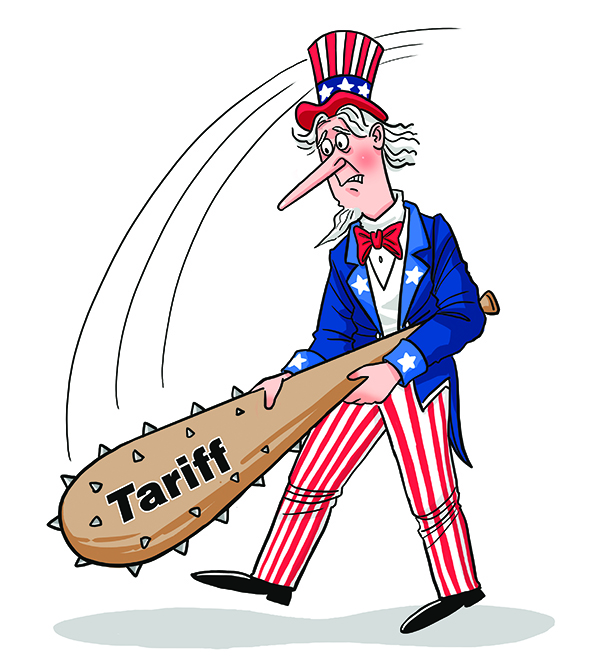

China can use US' own tactics to counter it

Editor's Note: China has reiterated that it doesn't want to be dragged into a trade war with the United States but is capable of safeguarding its interests if it is forced into one. How will the Sino-US trade dispute develop? Two experts share their views on the issue with China Daily's Yao Yuxin. Excerpts follow:

US retailers and customers bear the brunt of tariffs

The additional tariffs the US has imposed on Chinese products have had a far-reaching impact on US importers and agencies than Chinese exporters, and ultimately increased the price burden of US consumers, according to the Institute of World Economics and Politics, Chinese Academy of Social Sciences.

US retailers and customers have to bear the brunt of higher tariffs imposed by the US on Chinese goods, as US importers have to keep buying Chinese products for want of better substitutes, in order to meet domestic demand. As a result, US suppliers would lose their competitive edge, which in turn could hurt the US economy. No wonder many US think tanks and commercial groups oppose the new US tariffs-which by the way are also against the rules of free trade.

Bilateral trade has made the Chinese and US economies highly intertwined and interdependent.

Yet trade between the two largest economies fell 11 percent in the first four months of this year, with Chinese exports to the US falling by 4.8 percent year-on-year and imports from the US declining by as much as 26.8 percent year-on-year, according to China's customs authorities. Which shows that the trade conflict is affecting both the economies, albeit it is hurting the US more.

In the long run, therefore, China should take measures to diversify and expand its foreign markets, for example, by targeting developing countries along the Belt and Road, so as to reduce its over-reliance on the US as a trade partner.

Wang Yong, a professor at the School of International Studies, Peking University

China has three cards to outmaneuver US

Contrary to what some American politicians claim, a trade war between China and the US would not be in the interest of either country.

Yet, apart from imposing higher tariffs on Chinese goods, the US administration has also been using electronics chips as a weapon against China, which relies on their imports from the US. The US dominates almost 90 percent of the advanced chip industry, and most of the chips US companies produce are exported to China. In fact, Qualcomm, a major US chip-maker, earned 70 percent of its revenue last year by selling chips to China.

Since huge amounts of money need to be invested to design and make chips, many US tech companies could go bankrupt if they lose their biggest market once Washington imposes a complete ban on the exports of chips to China. Worse, Wall Street could crash because US stock markets are usually overvalued owing to the country's edge in high-tech.

The lack of high-end chips may slow China's efforts to upgrade its industrial system and prompt it to halt some of its cutting-edge projects. But the US ban would also encourage China to develop its own chip industry. In fact, China decided to catch up with the world's leading chip-makers in five years after the US banned the sales of chips to Chinese telecommunications company ZTE last year.

China can use three cards to emerge relatively unscathed from its trade conflict with the US.

First, it should ban the export of rare earths to the US. This will deal a big blow to the US chip-makers, because they won't get the non-ferrous metals derived from rare earths needed to make chips. China dominates the rare earths market, accounting for almost 95 percent of the total world production. Of course, the US could start mining rare earths, but it will take a long time for it to mine enough of the metals to meet its huge domestic demand. And by the time the US manages to mine enough rare earths to meet its demand, China would have become self-reliant in chip making.

Second, in the wake of the global financial crisis, China bought huge amounts of US Treasuries, which helped the US economy to recover. But now that the US is trying to arm-twist China into conceding its unreasonable demands, Beijing can sell the US bonds it holds.

And third, China is a huge market for many US companies, which made more than $380 billion in profits, compared with the about $20 billion Chinese enterprises made in the US in 2018. If US tech companies lose their biggest market, their share prices would fall sharply, dealing a blow to not only the companies but also the US economy as a whole.

Besides, requiring all companies to use the Beidou Navigation Satellite System in order to enter the Chinese market-just as the US administration does for GPS-would exclude many US companies from China and deal another blow to the US economy.

Jin Canrong, associate dean of the School of International Studies, Renmin University of China