Foreign investment law will boost protection

Favorable environment

To build a favorable business environment, the Ministry of Commerce and other government branches have pledged to continue to improve how local governments handle complaints lodged by foreign businesses. They will also add more areas to pilot free trade zones in Shanghai and Guangdong province, and devise policies to build a free trade port in Hainan province to bolster growth this year.

The nation's investment environment is expected to become more stable, open and transparent, said Wang Shouwen, vice-minister of commerce, at a news conference during the two sessions on Saturday.

Wang predicted that FDI will remain stable this year, while quality will be improved and structures will be optimized.

That opinion was shared by Robert Lawrence Kuhn, chairman of the Kuhn Foundation, who believes the draft foreign investment law backs up the government's words with actions. China has become a major champion of globalization and the mutual benefits of free trade, and by further opening its markets it is aligning domestic policy with its international strategy, he said.

According to the Ministry of Commerce, China attracted 84.18 billion yuan ($12.41 billion) in FDI in January, a rise of 4.8 percent from the same month a year before, while the nation's high-tech service industry saw a significant rise in the volume of foreign capital.

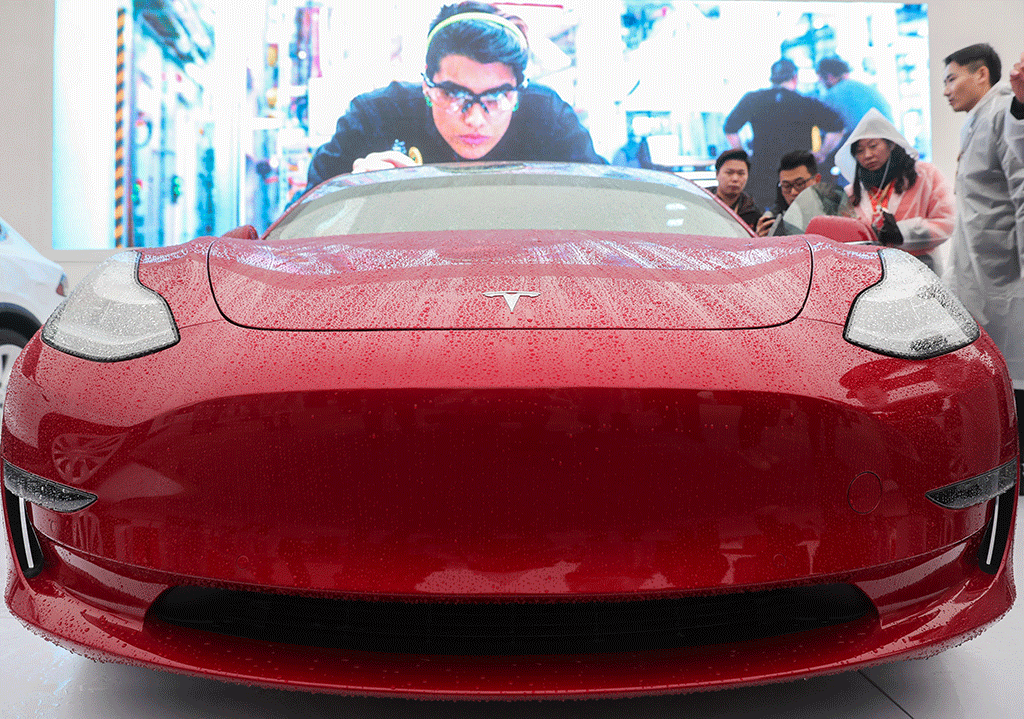

Also in January, Tesla, the US automotive and energy company, broke ground for its Shanghai plant. In doing so, it became the first foreign company to benefit from a new policy that allows non-Chinese carmakers to establish wholly owned subsidiaries in China. At$7.3 billion, it is the biggest foreign investment in Shanghai's manufacturing sector.

Zhang Yesui, spokesman for the Second Plenary Session of the 13th National People's Congress, said investments from Hong Kong, Macao and Taiwan are distinctive because they are not foreign investment, but are not entirely equivalent to domestic capital either. In practice, this means they are managed in the same way as foreign investments.

FDI in China is generally defined as investment activity conducted directly or indirectly by foreign nationals, companies and other organizations. In addition, it is classified as the establishment of foreign-invested companies, and acquisitions of shares, equity, property or other business interests in China by foreign investors through mergers and acquisitions.

When the new foreign investment law takes effect, the relevant legal arrangements will remain unchanged, and the laws regarding investment from Hong Kong, Macao and Taiwan will be continuously revised and improved in accordance with local needs to further provide a more open and easy business environment for investors from Hong Kong, Macao and Taiwan, Zhang said.

China has maintained stable FDI growth despite a gloomy global backdrop. Last year, FDI amounted to $135 billion, with the main sources being the European Union, the US, the Association of Southeast Asian Nations and Japan, according to the Ministry of Commerce.

Eager to grow their market share, a number of multinationals-such as German automaker BMW and US oil and gas producer Exxon Mobil-announced big-ticket investment plans in China last year.

In January, BASF signed a framework agreement with the provincial government of Guangdong to further clarify planning details for the German chemicals giant's $10 billion Verbund complex in Zhanjiang, a city in the southwest of the province.

Ren Xiaojin contributed to this story.

- AI should be used to inject more vitality into city culture, experts say

- Nobel laureate delves into whether life exists elsewhere at Fudan University

- Leonid meteor shower seen in China's Heilongjiang

- China moves to accelerate modernization of state forestry farms

- Autonomous vehicles charting new path

- Azerbaijani youth has a passion for Chinese language and culture