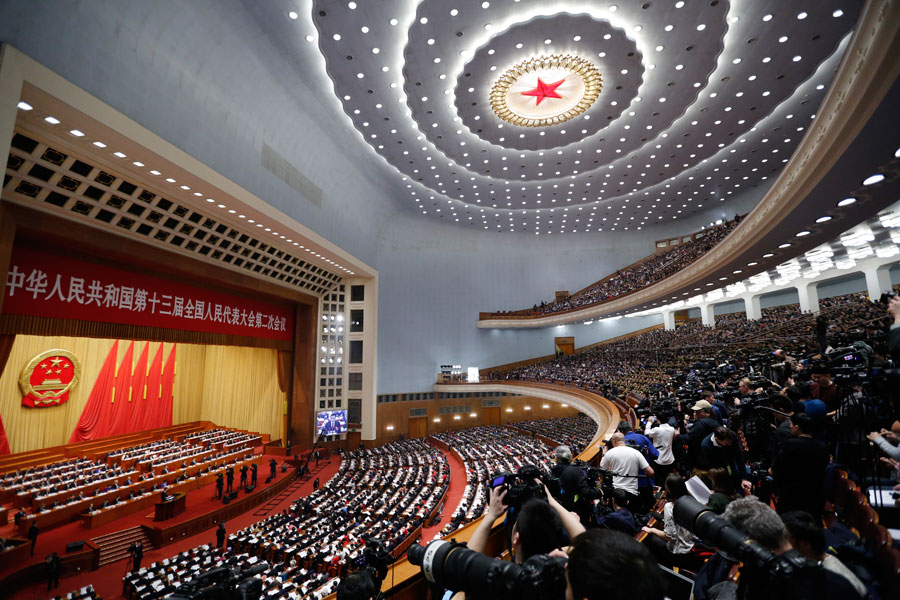

Highlights of 2019 Government Work Report

Share - WeChat

Corporate burdens

China aims to reduce the tax burdens and social insurance contributions of enterprises by nearly 2 trillion yuan ($298.3 billion) in 2019, as part of its broader push to promote manufacturing and fuel the growth of small and micro businesses.

The government will deepen the value-added tax reform, reducing the current rate of 16 percent in manufacturing and other industries to 13 percent, and lower the rate in the transportation, construction, and other industries from 10 to 9 percent.